Answer

Correcting a pay that has already been banked depends on the type of issue: whether it’s an incorrect pay item, an underpayment, an overpayment, or missed super. Follow the appropriate steps below.

Incorrect Pay Item Used

If an employee was paid the wrong pay item or rate (e.g. annual leave instead of sick leave), but the value of the pay remains unchanged (gross, tax, net, super), you can update the existing pay:

- Go to Pays > Navigate to the correct pay run.

- Edit the incorrect pay by clicking the edit pencil button.

- Update the pay item and save the changes.

Report this change to the ATO by sending an STP update event: Single Touch > Submit Payroll To ATO > Create update event. If an update event is unavailable, it may need to be submitted from the employee's latest pay run for the financial year. (Learn more)

Underpayments

If an employee was underpaid or if a pay item (such as wages or super) was missed, do not edit the original pay. Instead, record a new pay to correct the error. Leave the original pay unchanged for a clear audit trail.

Scenario 1: Correction for the Same Pay Run

This scenario applies if you have already completed the employee's current pay, meaning it has been saved, banked and/or reported to the ATO.

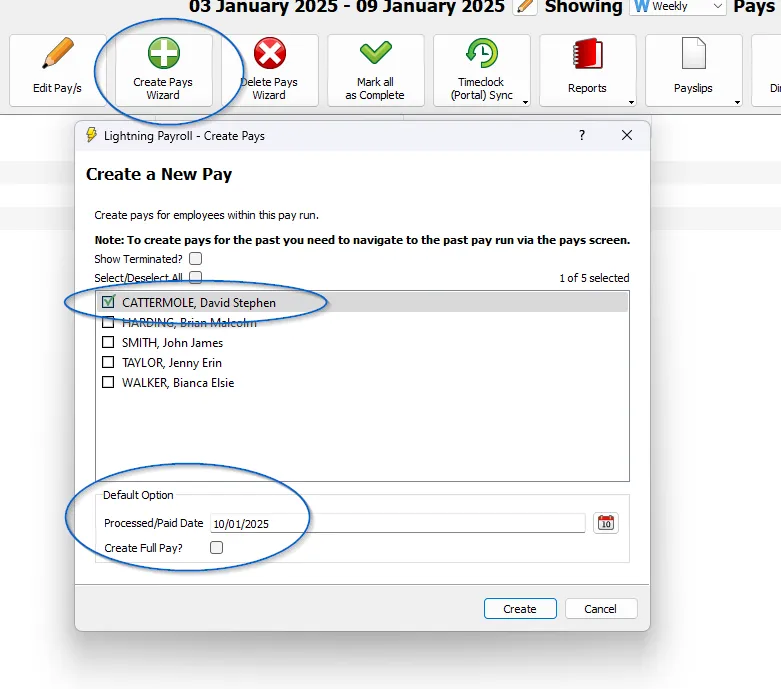

- Go to Pays > Create Pay Wizard.

- Ensure the processed date matches the banked date and untick Create Full Pay.

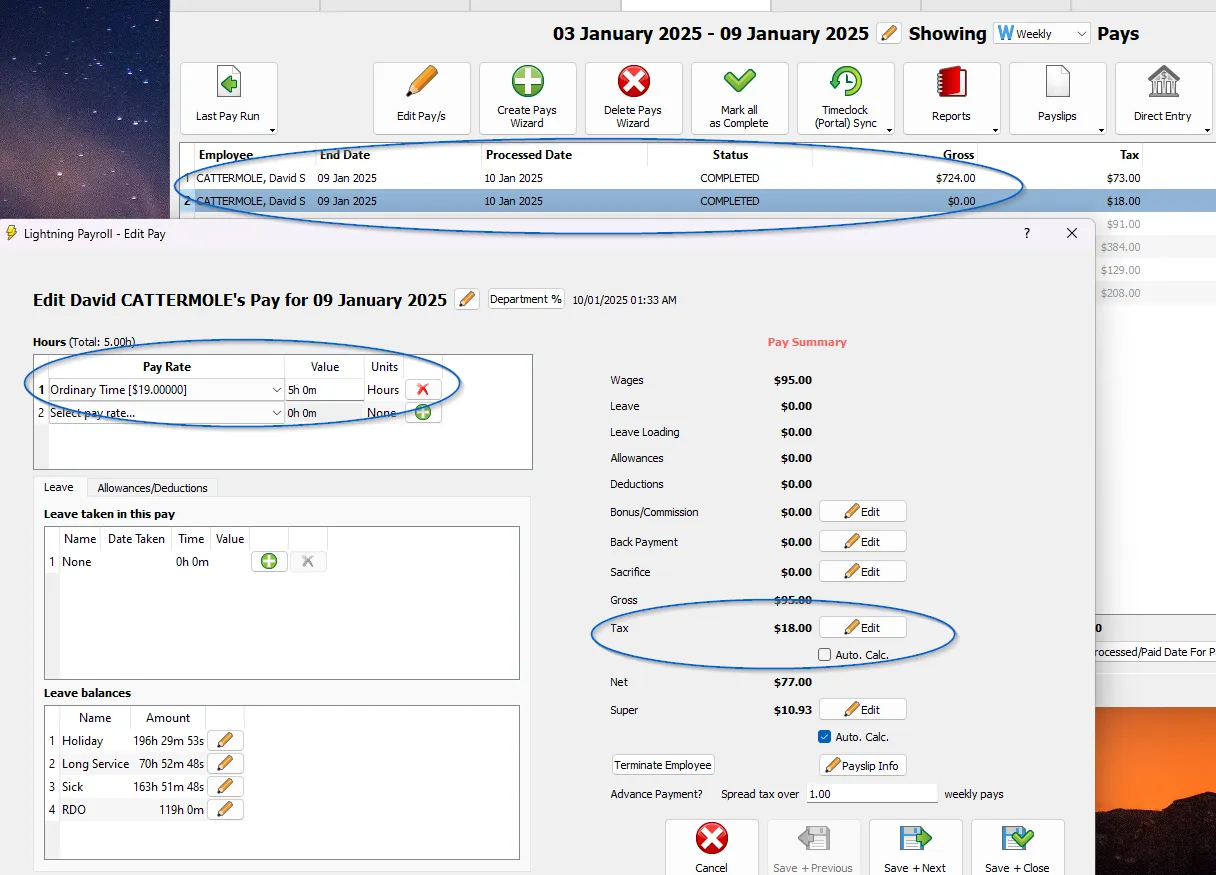

- Edit the second, $0.00 pay line for the employee.

Example 1: Missed or unrecorded items

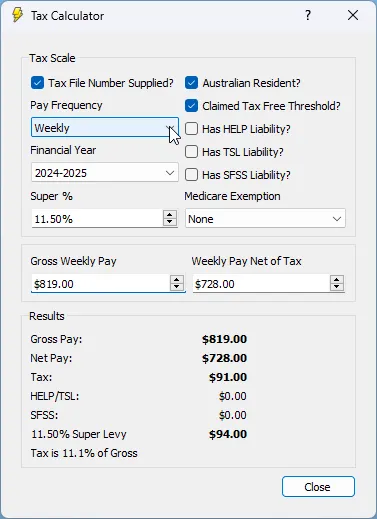

Add the missed items to the new pay and manually calculate the tax difference. Use the Tax Calculator in the Tools menu or temporarily edit (without saving) the original pay to determine the tax adjustment.

This example shows how the tax would be edited to record the difference of $18 tax required.

The Tax Calculator is found under Tools at the top of the program.

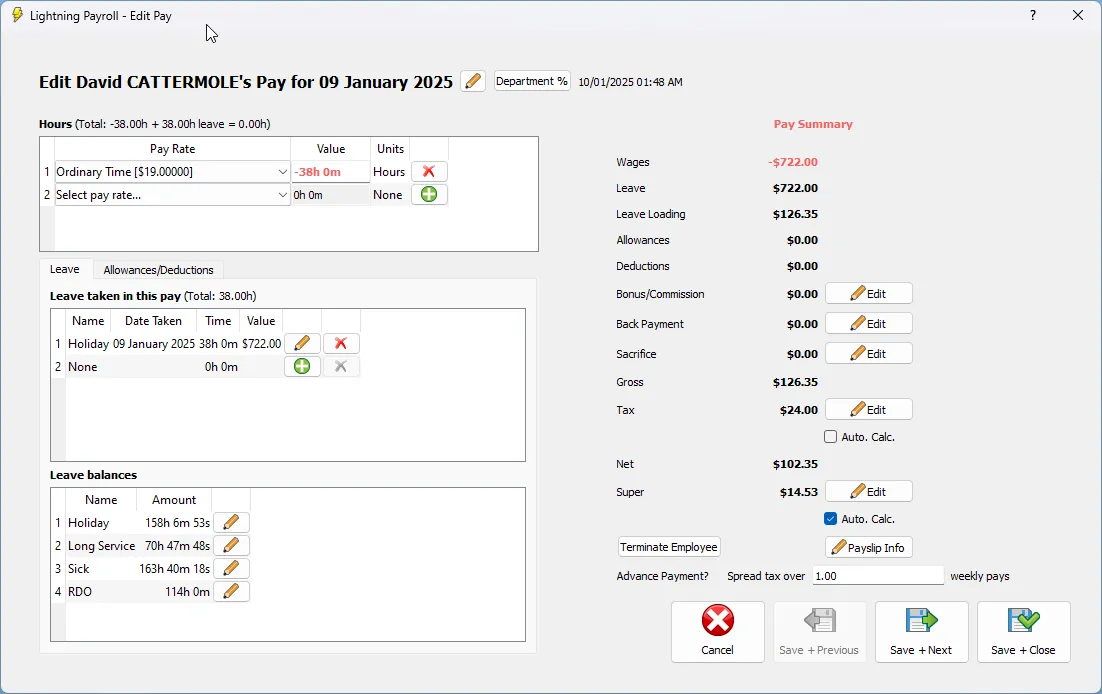

Example 2: Incorrect pay items

Enter a negative value for the incorrect pay item and a positive value for the correct one.

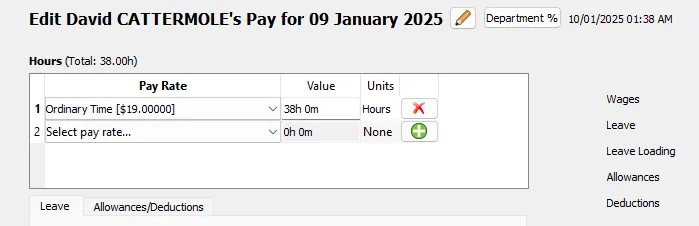

The employee was originally paid 38 hours ordinary time worked.

They should have been paid holiday/annual leave plus leave loading. Notice the correction where the OTE is cancelled via a negative entry alongside the corrected entry. The 38 hours OTE is cancelled out by the 38 hours leave, but the pay is increased by the leave loading amount which was the cause of the underpayment. Tax has been edited in this case to account for the required $24 which can be manually calculated using one of the two methods mentioned above.

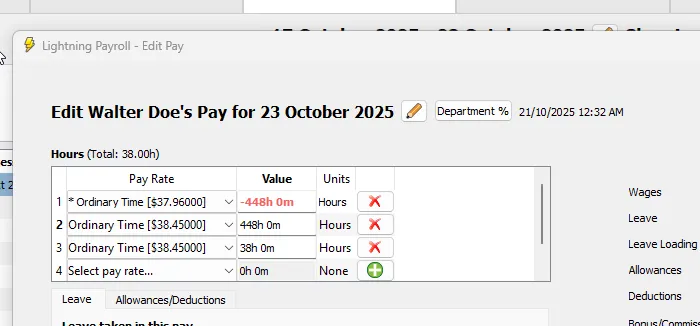

Scenario 1A: Underpayment due to incorrect hourly rate

This is common when an employee has been paid at the wrong ordinary rate across past hours. The cleanest fix is a swapover of the hours from the old rate to the correct rate inside the current pay. This creates the backpay difference automatically and keeps the audit trail intact.

Overview

- Enter the total affected hours as a negative line at the old rate.

- Enter the same hours as a positive line at the correct rate.

- Do this in one pay. You can include any normal wages owed for the period on additional lines.

Two stage process to access both rates in one pay

- Stage 1: Go to Employees > Pay Settings and temporarily set the employee’s main pay rate to the old, lower rate. Open the current pay in Pays and enter the negative hours against the old rate, then save the pay.

- Stage 2: Fix the employee’s pay settings to the correct rate. Return to Pays and re-edit the same pay. Add a new line for the positive hours at the correct rate. Leave the negative line untouched.

Example

If 448 hours were paid at $37.96 and should have been $38.45, enter -448 hours at $37.96, then +448 hours at $38.45. The backpay difference of $0.49 per hour is created automatically. PAYG will calculate from the final totals in the pay.

Tip: If you also owe ordinary hours for the current period, add them on a third line at the correct rate.

Scenario 2: Correction for a Previous Pay Run

Follow the same steps as Scenario 1. Alternatively, make the corrections in the employee's current pay run or create a second pay line via the Create Pays Wizard.

Super Corrections and RESC Additions

If you missed a superannuation contribution, including RESC (Reportable Employer Super Contributions), this should also be recorded in a new pay, not by editing the original. This applies to both unpaid and already paid super contributions.

Creating a new pay line helps:

- Preserve a clean audit trail

- Avoid altering amounts already banked or reported

- Ensure STP and super payment instructions are accurate

For EOFY RESC additions, see: How can I enter an additional RESC/super amount for EOFY?

For general super payment instructions, see: How do I pay super in Lightning Payroll (no clearing house required)?

Overpayments

Overpayments require careful handling. Refer to the Fair Work guidelines:

When overpayments occur, the employer and employee should discuss and agree on a repayment arrangement. A written agreement should include the reason, amount, repayment method, and schedule. If no agreement is reached, seek legal advice. (Learn more)

Deduct overpayments in upcoming pays by entering negative values for the overpaid item. For example, if 40 hours OTE were paid but only 30 hours were worked, deduct the 10 hours in the next pay. Ensure that no pay value (gross, tax, net, super) falls below $0. Arrange for deductions across multiple pays if necessary.

Example: Correction delayed to next pay due to negative result

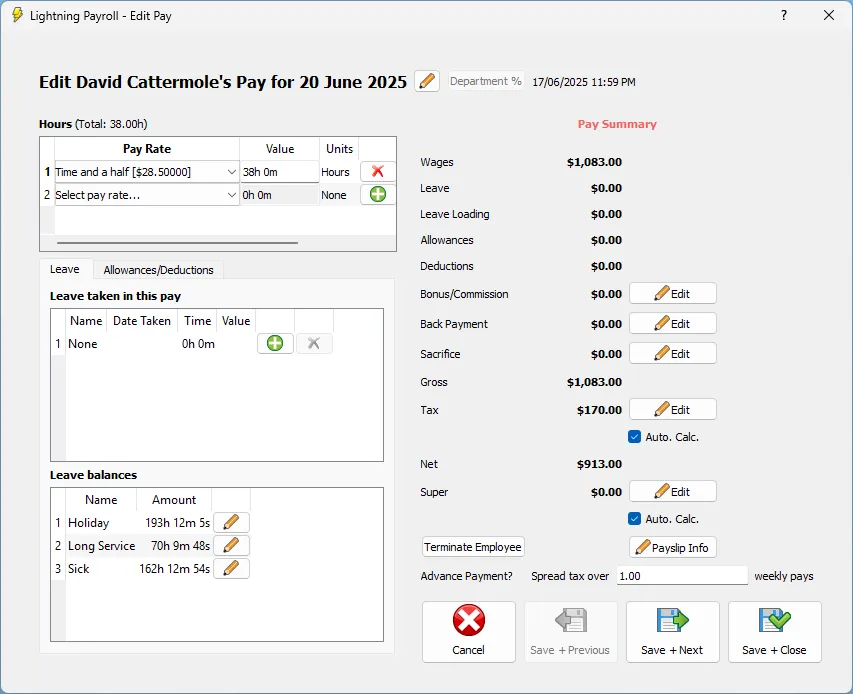

If an employee was mistakenly paid 38 hours at time-and-a-half instead of ordinary time, the typical correction would involve entering -38 hours at the incorrect rate and +38 hours at the correct rate. However, if there are no other pay items in the correction, this will result in a negative pay amount, which is not allowed.

The following image shows the overpayment made on June 20th, which should have been OTE.

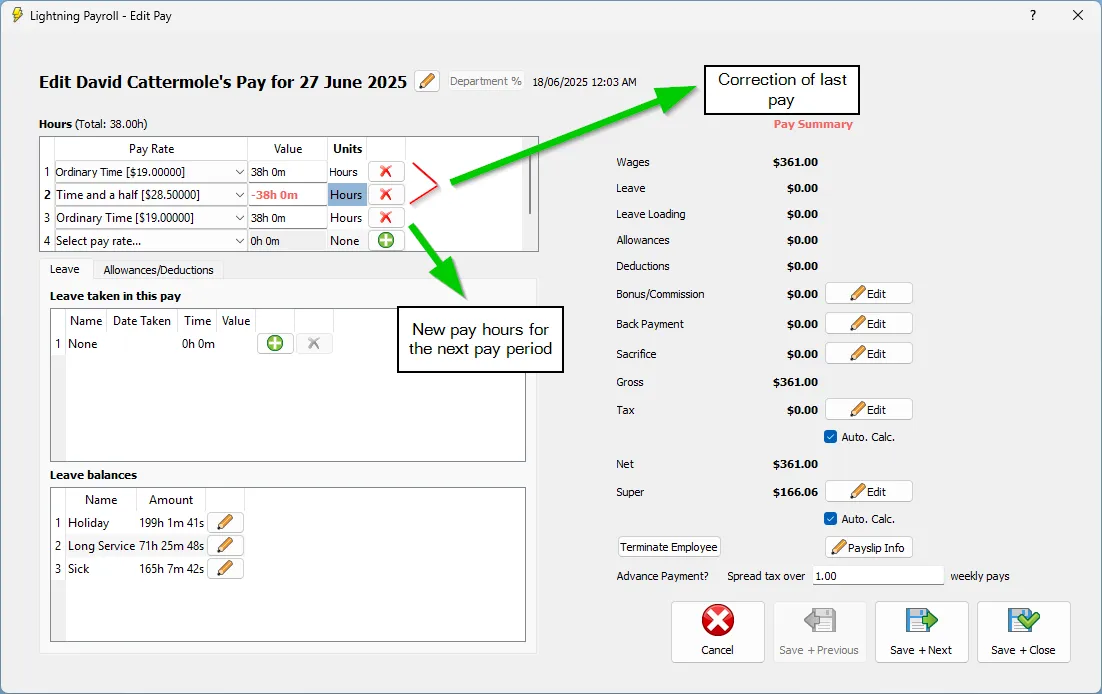

In this case, you should wait until the employee’s next pay run. Then:

- Include the correction in their regular pay.

- Enter -38 hours at time-and-a-half (to cancel the overpaid portion).

- Enter +38 hours at ordinary time (to restore the correct pay).

This ensures the overpayment can be recovered against other earnings in the same pay, keeping the overall pay valid and payable.

STP Reporting

Corrected overpayments or underpayments must be reported via Single Touch Payroll. Submit a new event (pay event) to correct both