Answer

The Australian Government is providing funding for Early Childhood Education and Care (ECEC) worker retention payments, which will run from 2 December 2024 to 30 November 2026. This funding includes a 15% wage increase for eligible staff and additional funding for on-costs. Providers must pass this payment to workers through wage increases.

Adding ECEC Retention Payments in Lightning Payroll

To process these payments in Lightning Payroll, you’ll need to create three types of allowances:

- Company Allowances: These allowances are set up under Company > Allowances and can be shared across multiple employees. After setting up a company allowance, you must add the appropriate employees to it for it to apply to their pays.

- Employee Allowances: These allowances are specific to an individual employee and can be created under Employees > Allowances/Deductions > Allowances. Employee allowances are useful if you need to define a specific per-pay allowance amount for a single employee.

Steps to Add Company Allowances

- Open Lightning Payroll and navigate to Company > Allowances.

- Click on the plus to add a new company allowance.

- Enter the details as shown below:

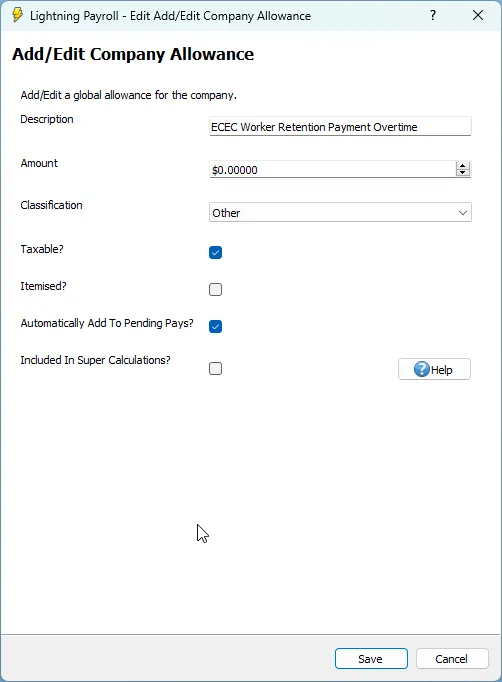

Overtime Allowance:

- Description: ECEC Worker Retention Payment Overtime

- Amount: $0.00000

- Classification: Other

- Taxable: Yes

- Itemised: No

- Automatically Add to Pending Pays: Yes

- Included in Super Calculations: No

Refer to the image below for a visual guide:

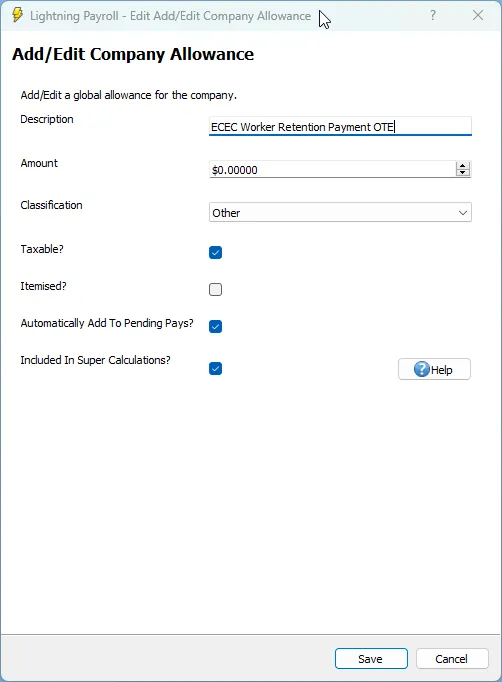

OTE Allowance:

- Description: ECEC Worker Retention Payment OTE

- Amount: $0.00000

- Classification: Other

- Taxable: Yes

- Itemised: No

- Automatically Add to Pending Pays: Yes

- Included in Super Calculations: Yes

Refer to the image below for a visual guide:

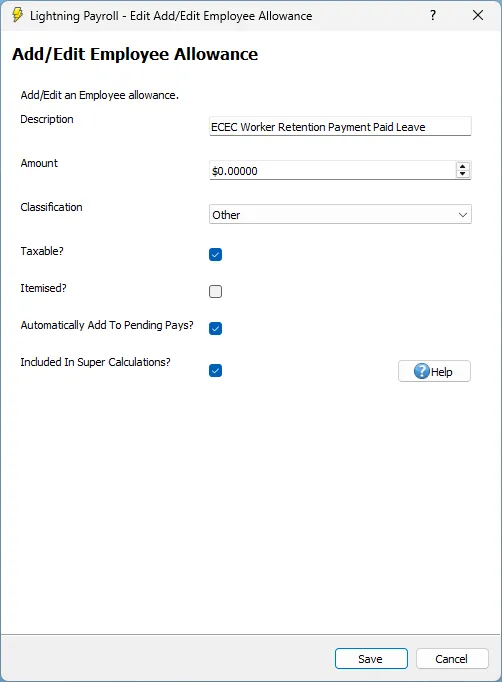

Paid Leave Allowance:

- Description: ECEC Worker Retention Payment Paid Leave

- Amount: $0.00000

- Classification: Other

- Taxable: Yes

- Itemised: No

- Automatically Add to Pending Pays: Yes

- Included in Super Calculations: Yes

This allowance should be used to ensure the retention payment component also applies when an employee is on paid leave, such as annual or personal leave. It ensures consistency with Fair Work guidance that the allowance applies to all ordinary time earnings.

Steps to Add Employee Allowances

- Open Lightning Payroll and navigate to Employees > Allowances/Deductions > Allowances.

- Select the employee for whom you want to add the allowance.

- Click on the plus to add a new employee allowance.

- Enter the details, including a specific amount if applicable, and save.

Additional Notes

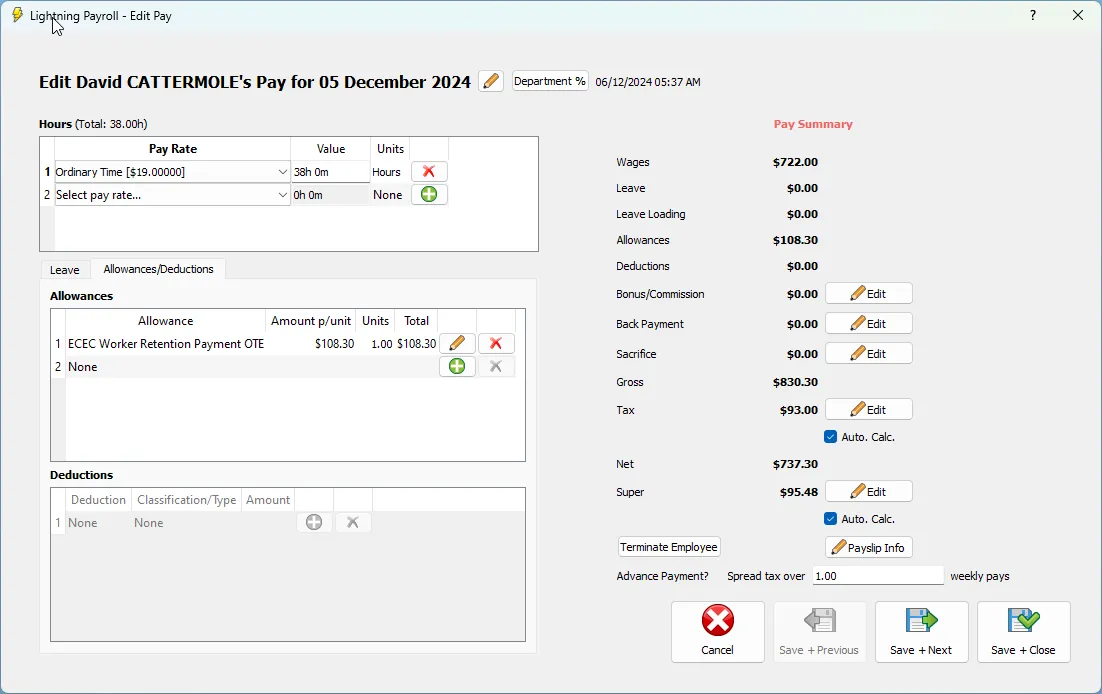

Once the allowances are created, they can be added to individual employee pays. For company allowances, ensure you assign the relevant employees to the allowance. For employee allowances, the amount is typically specific to the individual and can be updated on a per-pay basis or set as a recurring base amount.

Leave Accruals

ECEC retention payments will not affect an employee’s leave accruals. In Lightning Payroll, allowances do not impact leave balances regardless of their settings.

If you'd like to learn more about how leave accruals work in Lightning Payroll, see our FAQ: How Does Lightning Payroll Calculate Leave Accruals?

If you need further assistance, feel free to reach out to our support team or visit the official page for more details.