Answer

For a basic termination, please see our FAQ here.

Getting started with the termination assistant

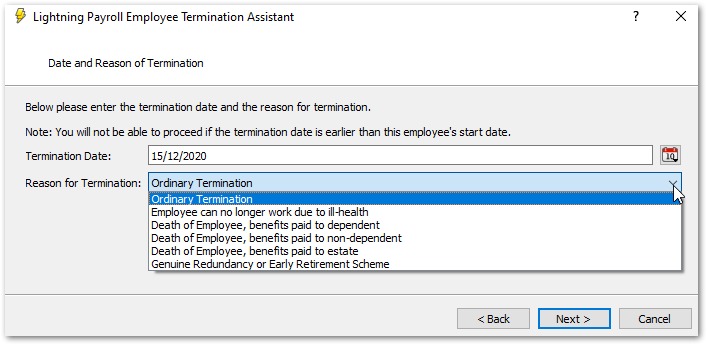

The first screen of the termination assistant asks you to enter the termination date and select a reason for termination. With the exception of a genuine redundancy or other listed circumstances, ordinary termination is typically the appropriate option.

If you select genuine redundancy, you will be prompted to enter the redundancy payout amount on this screen. Please see the ATO’s redundancy payments page for more information.

Select non-ETP payout options

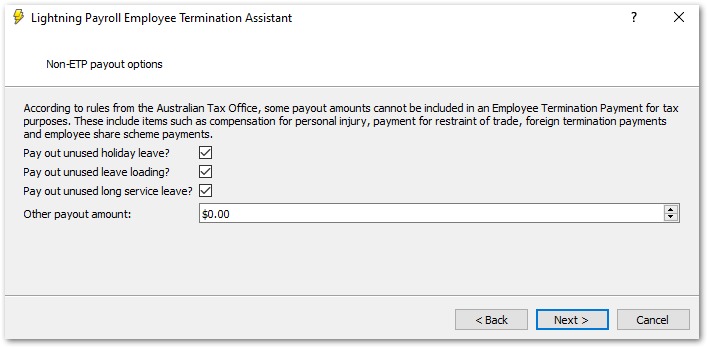

On the next screen you can choose which non-ETP items to pay out. This is where you select or deselect leave types to include in the termination. Lightning Payroll calculates the payout based on the employee’s hourly rate, any leave loading, and their current leave balance in hours and minutes.

You can also add other non-ETP amounts here. See the ATO’s table for unused leave payments on termination for details on tax treatment.

ETP options and payment in lieu of notice

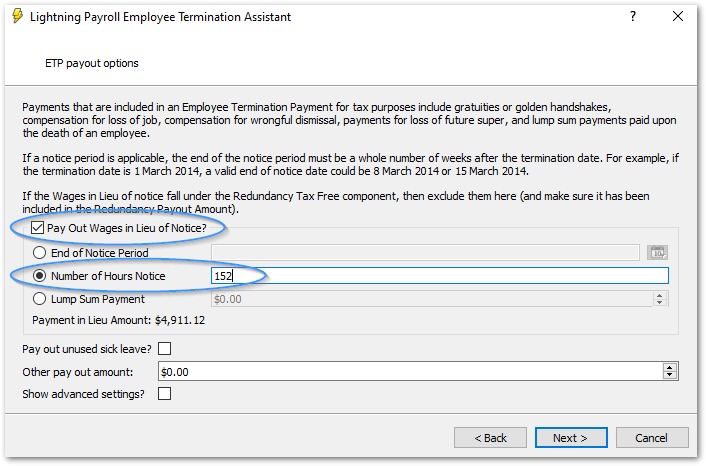

The following screen is for ETP options. A common example is payment in lieu of notice. If you do not need to include any ETP items, click Next to skip this step.

There are several ways to calculate a payment in lieu of notice. The most common is Number of Hours Notice. In the example below, four weeks of notice equals 152 hours, based on a 38-hour week. Your amount may differ depending on the relevant contract or award.

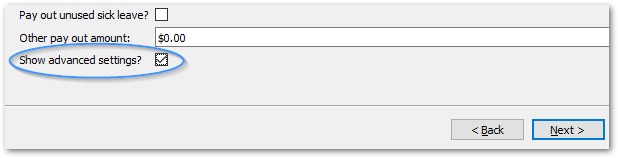

You can also choose to pay out unused sick leave if required. An Advanced settings button is available on this step.

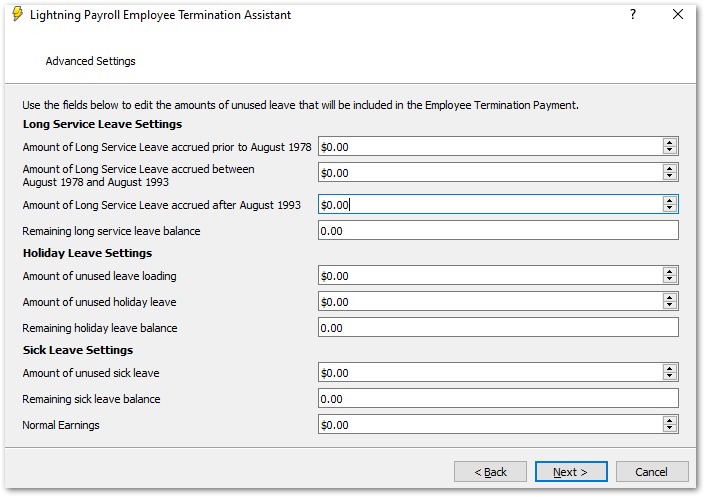

Advanced settings

The advanced settings screen lets you review and, if necessary, edit the lump sum leave balances that will be paid out before completing the termination.

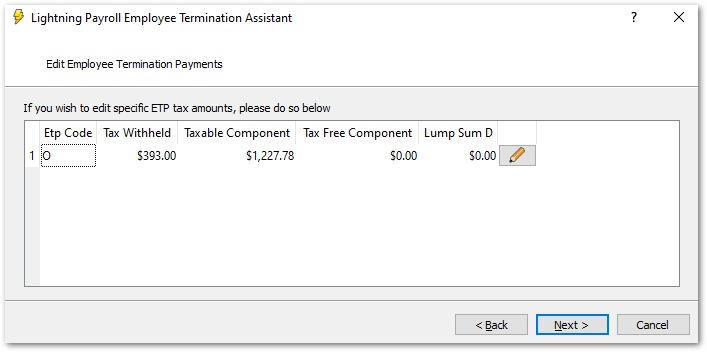

ETP codes and tax amounts

After clicking Next, you will reach a screen that shows ETP codes and allows you to edit ETP tax amounts where required. This is particularly helpful when processing genuine redundancies.

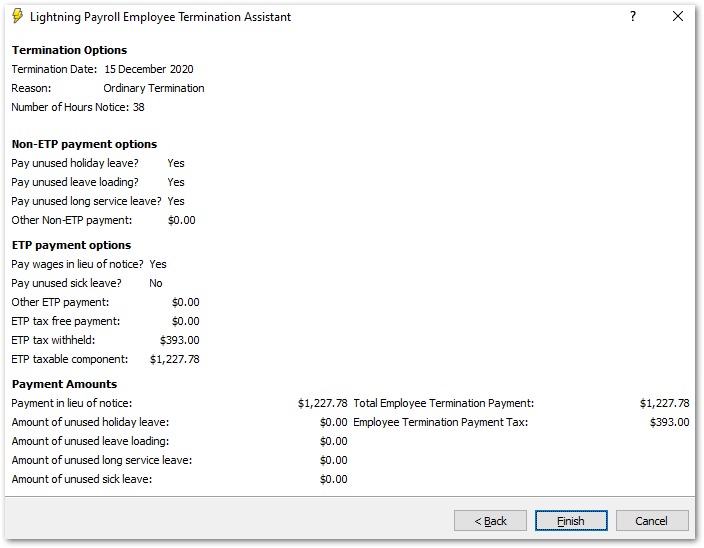

Termination summary and finishing up

The final screen shows a complete termination summary. Review all amounts and payout types. If everything looks correct, click Finish to complete the termination.

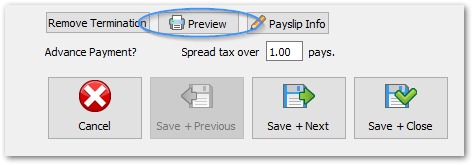

If you would like a report of the termination you have just completed, click Preview.

What is payment in lieu of notice

Payment in lieu of notice is when employment ends immediately, and instead of the employee working out their notice period, the employer pays what the employee would have earned during that notice period.

How it is calculated

- Fair Work guidance says the payment must be at the employee’s full pay rate as if they had worked the minimum notice period.

- This full pay rate includes any loadings, allowances, penalty rates and other separately identifiable amounts that would reasonably have applied during the notice period.

- For example, if the employee’s regular pattern includes weekend penalties during the notice period, those penalties should be reflected in the payment.

Download Fair Work’s Notice of termination and redundancy pay guide (PDF)

Tax, reporting and super overview

- Reporting: Payment in lieu of notice is generally reported as an ETP in payroll reporting. Your software will tag this correctly when entered on the ETP step.

- Tax: ETPs have specific tax treatment and caps. Check the ATO rules for the employee’s circumstances.

- Superannuation: The ATO’s super guidance treats payment in lieu of notice as ordinary time earnings for super purposes, so super usually applies.

Overtime and payment in lieu

- Unpaid overtime already worked up to the termination date should be paid as outstanding wages.

- Hypothetical or discretionary overtime that might have been worked during the notice period is not added on top. Only include penalty rates or regular rostered components that form part of the employee’s expected pattern during the notice period.

Payments made after the death of an employee

Lightning Payroll can handle ETP payouts made after the death of an employee. Non-ETP amounts such as unused annual leave, leave loading and long service leave accrued post-1993 are not paid via the deceased employee’s termination screen.

The ATO explains this here: Withholding from unused leave payments on termination of employment.

"You do not withhold from payments for unused annual leave, leave loading and unused long service leave made after the death of an employee.

Do not show these payments on your deceased employee’s payment summary."

These amounts need to be manually calculated and transferred outside of payroll to the appropriate party, for example a dependant or an estate.