Answer

Employee reimbursements should not be entered in Lightning Payroll. If added to a pay, they will be reported to the ATO via Single Touch Payroll (STP), which can misstate an employee’s taxable earnings.

Reimbursements are typically handled separately from payroll (for example, via a direct bank transfer or petty cash), so they are not included in STP reporting.

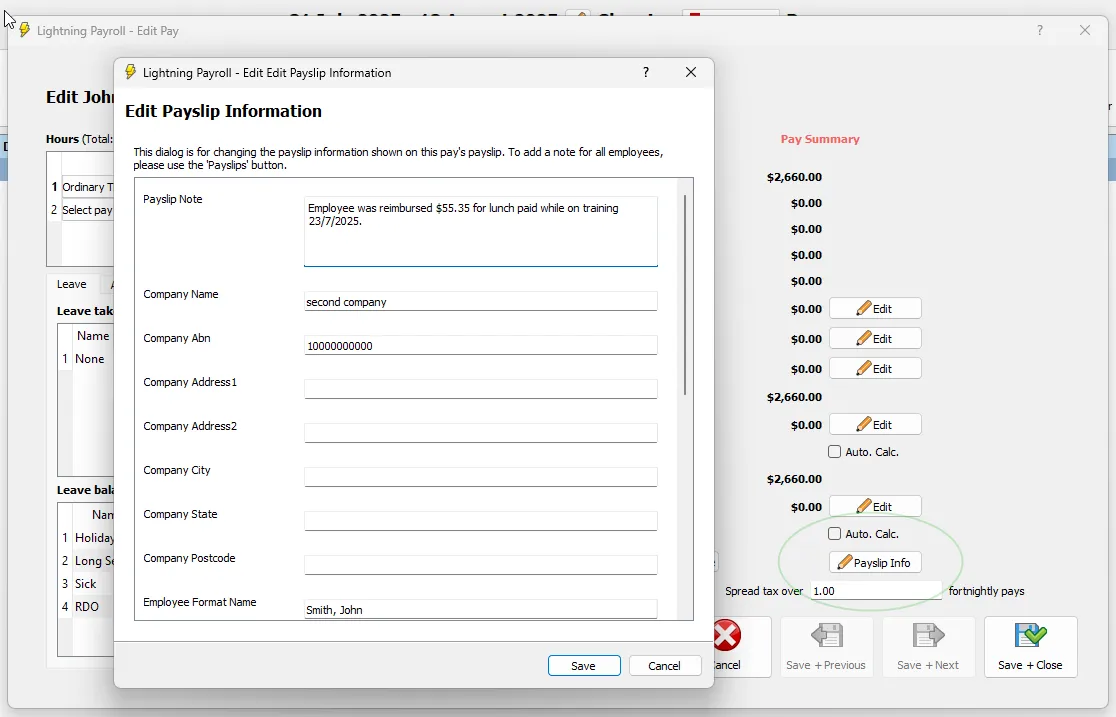

If you want the reimbursement mentioned on the payslip without affecting pay totals or STP, add a payslip note to that pay only:

- Open the employee’s current pay and click Edit Pay.

- Go to the Payslip Info tab.

- Type your message in the Payslip Note field (e.g. “Reimbursement of travel expenses paid separately”).

- Click Save.

This records the information for the employee while keeping the reimbursement out of payroll figures and STP submissions.