Answer

As per the Australian Taxation Office (ATO), superannuation must be paid to employees under 18 years of age if they work more than 30 hours in a week, regardless of how much they earn. This is outlined in Superannuation Guarantee Determination SGD 93/1, which specifies that the calculation is based on the actual hours worked in a single week. You cannot average these hours across fortnightly or monthly pay periods.

Using Lightning Payroll to Apply the ATO Guidelines

Lightning Payroll includes a setting to assist with superannuation calculations for employees under 18. You can find this setting under:

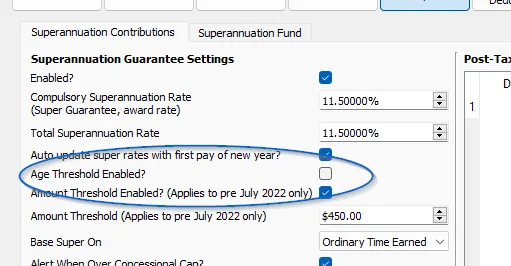

- Employees > Super > Superannuation Contributions > Age Threshold Enabled

When enabled, this feature automatically applies the ATO’s rule that super is only paid if the employee works over 30 hours in a single week. However, this setting works perfectly only for employees who are paid weekly. For employees paid fortnightly or monthly, additional steps are required due to the complexity of tracking weekly hours within these pay cycles.

Options for Managing Super for Under-18 Employees Paid Fortnightly or Monthly

If your employee is paid fortnightly or monthly, here are some options:

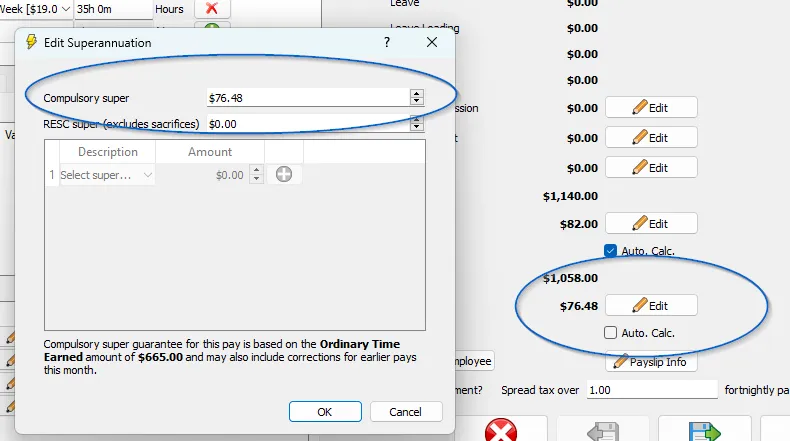

- Edit the super manually: For each pay period, click “Edit” beside super and adjust the “Compulsory Super” amount manually based on the hours worked.

- Disable the age threshold: Treat the employee as if they are over 18 years old by disabling the “Age Threshold Enabled” option. This will result in paying super on all earnings, regardless of hours worked.

- Configure pay rates: Set up different pay rates for hours with and without super as follows:

Setting Up Pay Rates for Hours With and Without Super

To configure pay rates, follow these steps:

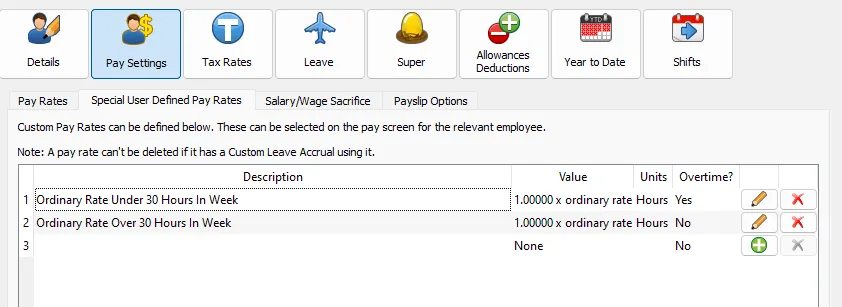

- Navigate to Employees > Pay Settings > Special User Defined Pay Rates, or use Company > Pay Rate Groups if the rates are shared among multiple employees. See our FAQ on setting up pay rate groups here.

For an individual employee:

- Create one pay rate with the type “Normal”, set to a multiple of 1x their ordinary base pay rate. Name this rate something like “Ordinary Rate Under 30 Hours In Week” and mark it as Overtime so super does not apply.

- Create a second pay rate, also of type “Normal”, but do not mark it as overtime. Name this rate “Ordinary Rate Over 30 Hours In Week” so super will apply.

Once set up:

- Go to Employees > Super > Superannuation Contributions and untick “Age Threshold Enabled” to manually manage super.

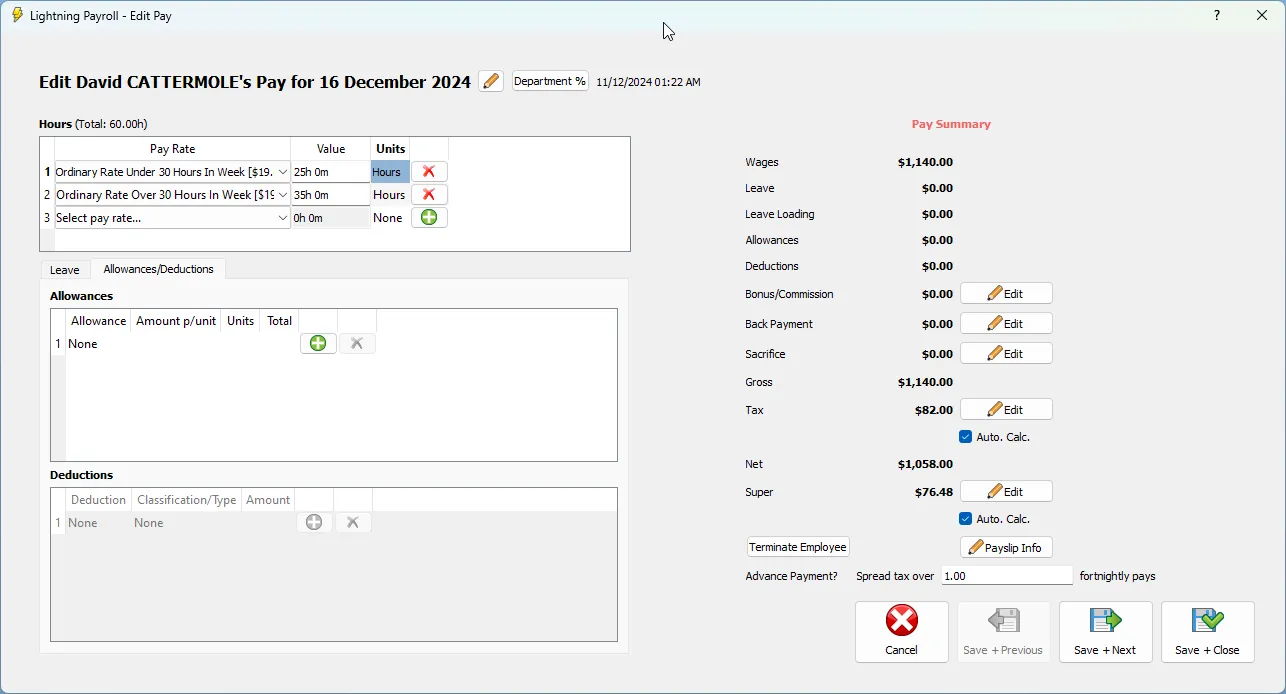

- When processing a pay, select the appropriate pay rate for the hours worked under and over 30 hours in the week. Enter the hours accordingly to apply super to the correct portion. In the following example the employee has worked 25 hours one week (no super to apply), and 35 hours in another week. At $19 per hour the 11.5% super should only calculate on the 35 hours ($665), resulting in a rounded super amount of $76.48.