Answer

Time In Lieu (TIL) and Superannuation Rules

Time in Lieu (TIL) has specific treatment under the ATO’s STP Phase 2 reporting requirements. These rules impact how superannuation is calculated and reported in Lightning Payroll.

What Makes TIL Different?

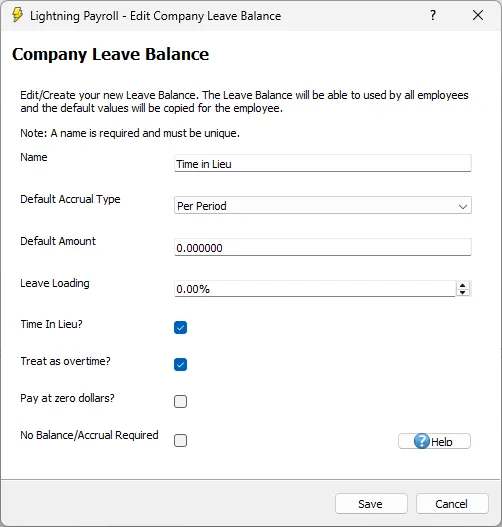

Unlike other custom leave types (such as RDOs), TIL has mandatory reporting rules. In Lightning Payroll, any custom leave type marked as "Time In Lieu?" will follow these rules, regardless of other settings.

When Is TIL Considered OTE?

- TIL Taken: If TIL is taken as leave (not cashed out), it is treated as Ordinary Time Earnings (OTE), and superannuation is always payable.

- TIL Cashed Out: If TIL is cashed out during employment, it is treated as Overtime, and superannuation is not payable.

What Happens to the "Treat as Overtime?" Setting?

If a leave type is marked as "Time In Lieu?", the "Treat as overtime?" checkbox is ignored. This is because TIL treatment for STP reporting and superannuation is already set by the ATO:

- Cashing out TIL is always treated as Overtime for STP reporting.

- TIL taken as leave is always reported as Other Paid Leave and included in OTE, regardless of the "Treat as overtime?" setting.

For more details on ATO reporting categories such as Other Paid Leave and Overtime, including how TOIL is treated, please refer to the ATO’s STP Phase 2 employer reporting guidelines.

Setting Up TIL or RDO Leave Types

You can set up custom leave types in the program for things like RDOs and Time Off in Lieu by following these steps:

- Go to Company >> Leave Balance and click Create Leave Balance to create your custom leave type.

- Once the leave type exists, go to Employees >> Leave >> Leave Accruals.

- Use the green plus symbol to add the newly created leave type to each employee who requires it.

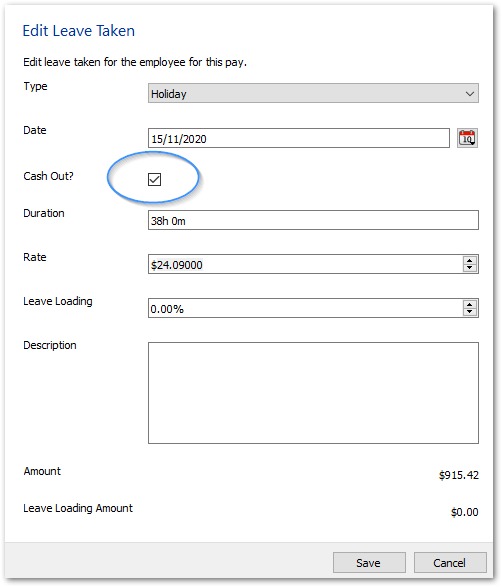

What Should I Do When Paying Out TIL?

If an employee is being paid out their TIL balance instead of taking it as leave:

- In their pay run, select the appropriate TIL leave type.

- Tick the "Cash Out?" option to ensure the leave is treated correctly for STP reporting and superannuation.

- Superannuation will not be paid on cashed-out TIL.

- Do not use the "Spread Tax" feature when cashing out TIL.

Summary

- Only tick "Time In Lieu?" for genuine TOIL leave types.

- When "Time In Lieu?" is ticked, Lightning Payroll will automatically apply ATO rules and ignore the "Treat as overtime?" setting.

- Cashing out TIL = no super. Taking TIL = super owed.