Answer

As an employer, you must first offer eligible employees a choice of superannuation fund. If they don’t exercise their choice, you must check whether they have a “stapled super fund” (an existing account tied to them that follows them from job to job) via the Australian Taxation Office (ATO). Stapled super funds for employers outlines the rules.

Once you have the correct super fund (either the employee’s choice, their stapled fund, or your nominated default fund if neither applies) you can register a new super account within Lightning Payroll as follows:

Registering a Super Fund for a Single Employee

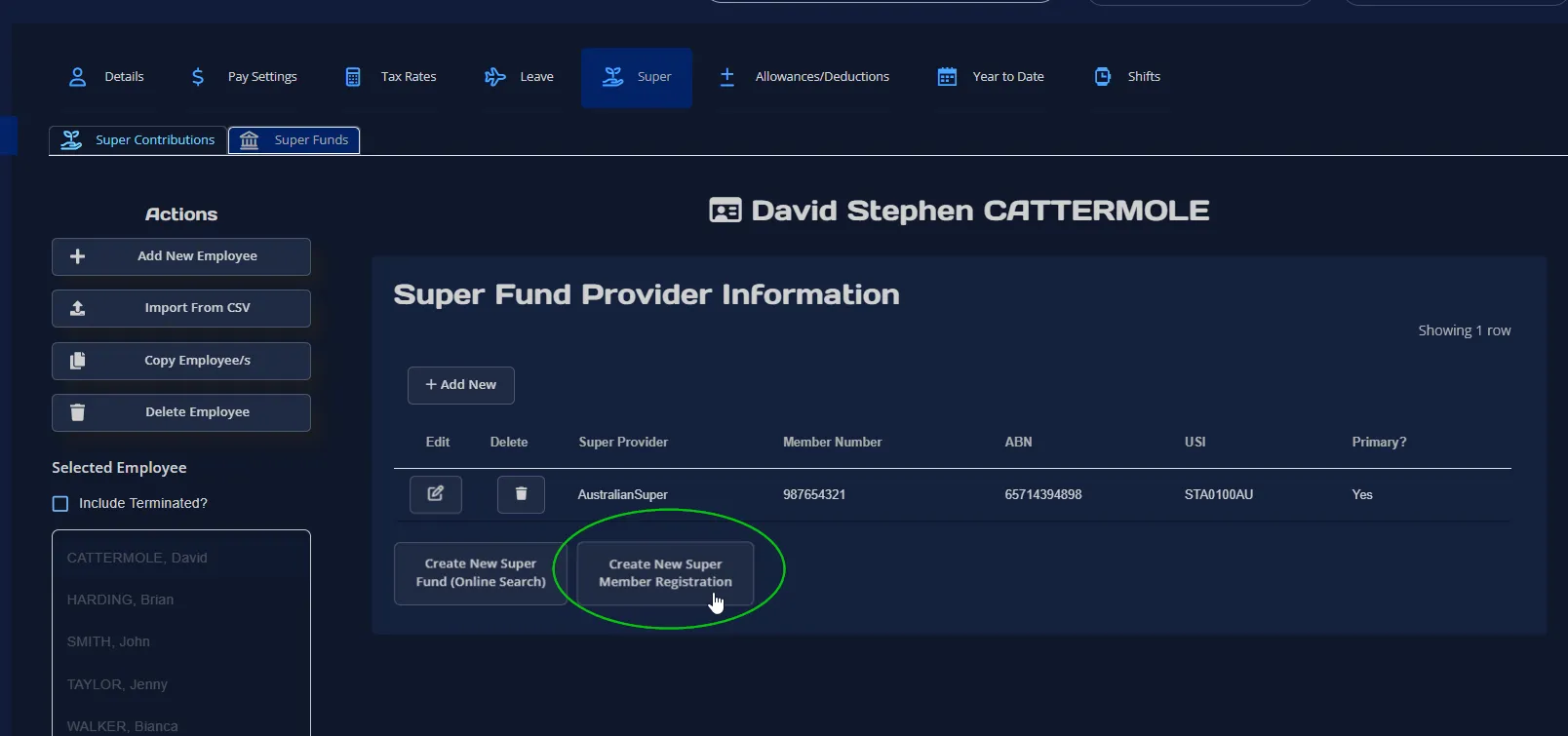

Navigate to Employees >> Super >> Superannuation Fund in Lightning Payroll.

Follow these steps:

- If the desired super fund already exists in your system, select it and proceed to register the employee under it.

- If the fund does *not* already exist in Lightning Payroll, click the button labelled Create New Super Fund (Online Search). This will let you enter the fund’s USI (Unique Superannuation Identifier), query the ATO database and import the fund’s details automatically.

Registering Multiple Employees with a Super Fund

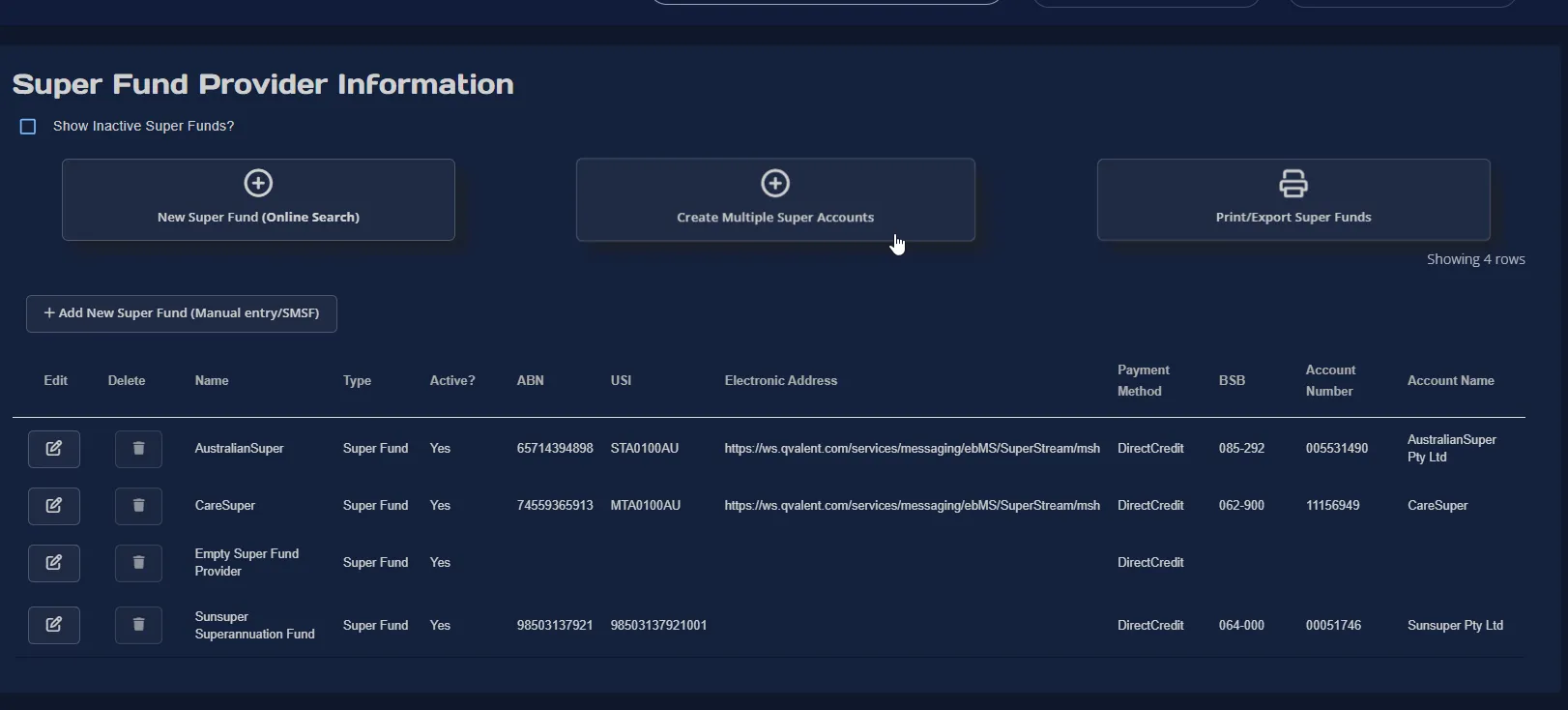

When you need to create multiple super accounts under the same fund at once, go to Settings >> Super Funds >> Create Multiple Super Accounts.

Follow these steps:

- Ensure the super fund is already in your system. If it isn’t, again use the Create New Super Fund (Online Search) button.

- Proceed via the prompts to specify which employees will have accounts created under the fund.

- Send the registration request to the fund. The fund will respond (via email and the Lightning Payroll “Super Fund Deposits >> SuperStream Mailbox” area) within a few days with a member number for each employee.

If you have any further questions, please consult our support documentation or contact our team.