Answer

You may notice that some amounts in the STP reports (Detailed and Summary) do not match gross totals in the Group Tax or Pay Summary reports. This is likely due to one of the following reasons:

- Since STP 2.0 (released in January 2022), gross amounts are 'disaggregated' so to match the STP reports with regular reports (pay summary, group tax, etc) you should match the total (exc sacrifice) column in the STP report with the gross in a traditional report.

- Missing employees? Remember that sending a new event only includes employees from that pay run. You'll need to go back around for a second STP lap, and submit an update event to finalise with everyone at the same time.

- Please ensure you are running your comparison reports by processed date from 1/7/XXXX to 30/6/XXXX as STP/YTD amounts are gathered using these parameters by default.

-

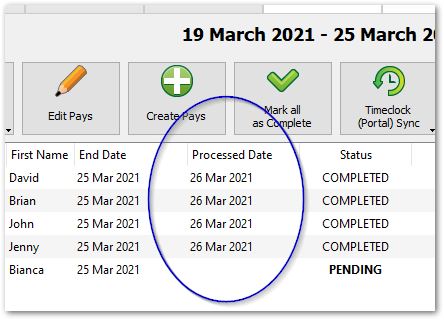

Ensure your pay runs are marked with the correct processed date (date of payment), as the FY should only include pays made within those dates.

Use the Set Processed/Paid Date For Pay Run tool at the bottom of the Pays screen to quickly correct any mistakes in the processed date. For more info on how Lightning manages pay dates see our FAQ here.