Answer

In late 2021, Lightning Payroll will be updated (versions 2022.3 and above) to include Single Touch Payroll Phase 2 changes, required to be used by all employers as at January 1st, 2022.

These changes are mostly behind the scenes in Lightning Payroll, but you will notice a number of differences and you may also have to slightly alter the way you enter certain pay items. Key changes are described here, by the ATO, these are:

- Disaggregation of gross

- Directors fees

- Cents are now included

- Classification of back payments

- Employment and taxation conditions

- Income types

- Built-In leave types

- Removal of pre-tax deductions

- Country codes

- Child support garnishees and child support deductions

- Reporting previous business management software IDs and payroll IDs

- Time in lieu

- Cessation/Termination reasons

See below for information on how each of these changes are handled in Lightning Payroll.

Disaggregation of Gross

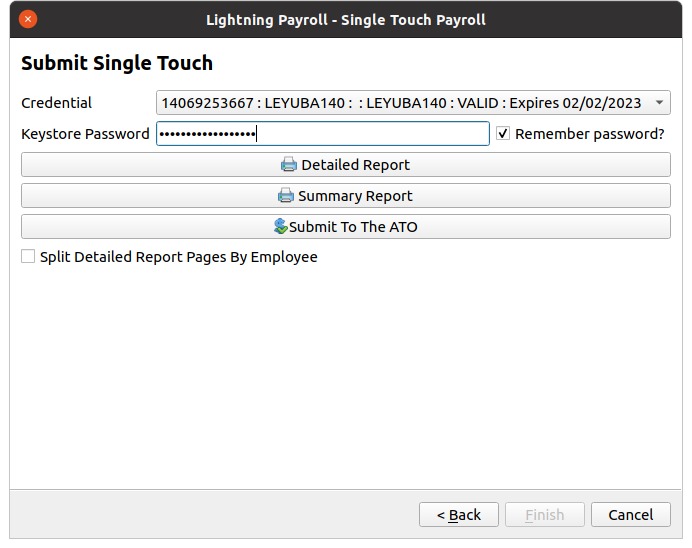

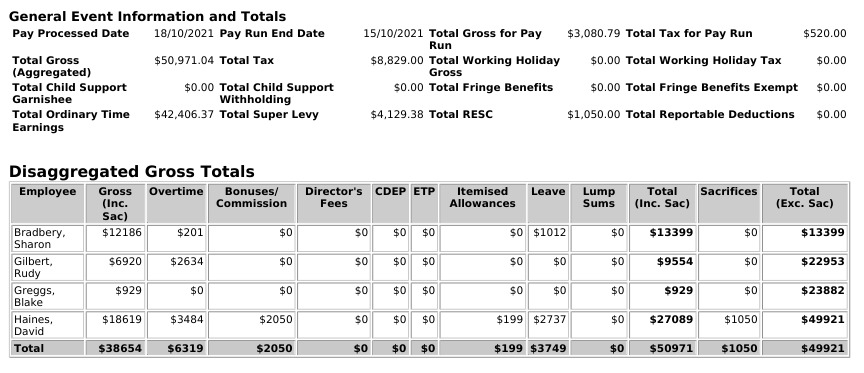

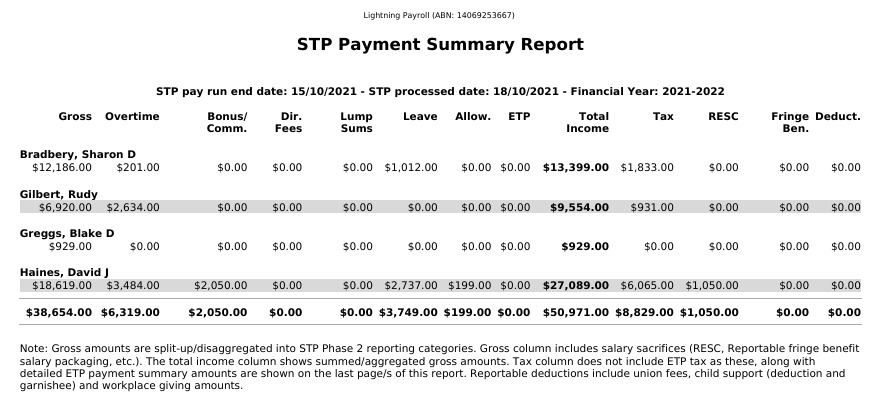

Gross has always been disaggregated, or split-up to a degree when reporting to the ATO. Itemised allowances and ETP amounts have typically been broken apart. STP2 goes a lot further and splits out additional YTD amounts such as bonuses, leave, overtime and more. You will notice these in the new Single Touch Payroll reports (detailed and summary versions) now shown on the STP submission screen.

The Detailed Report shows individual employee YTD amounts grouped by income stream (described below), and totals broken down into disaggregated gross amounts. When comparing these amounts to other reports in Lightning Payroll (E.g. Pay Summary, Net Balancing, etc.) please keep in mind that anytime Gross amounts are mentioned, they are aggregated/combined, as disaggregation only occurs here, when submitting STP. Another point to note regarding non-STP/traditional reports is that gross values exclude sacrifices, raw gross values include sacrifices.

The Summary Report aims to provide an overview of the submission. It excludes detailed individual employee breakdowns and aims to show the disaggregation alongside total tax, RESC and deduction amounts.

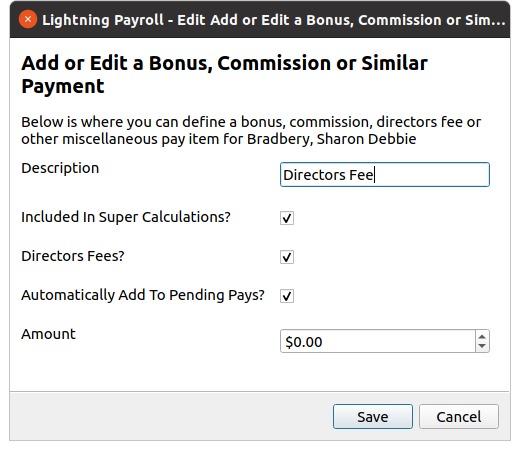

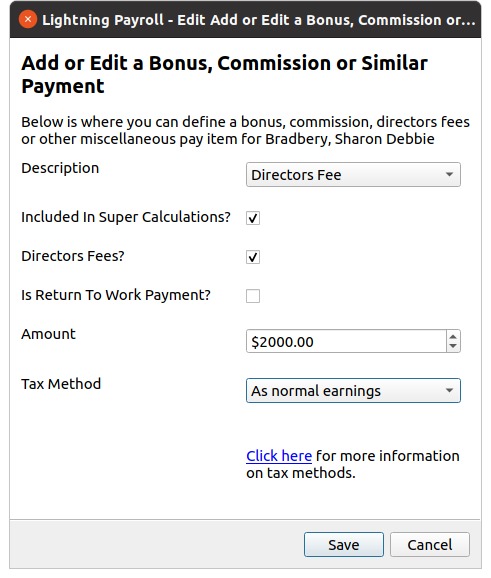

Directors Fees

Directors Fees are now to be reported through STP. These are entered into Lightning Payroll via the Bonus/Commission sections, by ticking the Directors Fees? box.

Bonuses (including Directors Fees, Commissions, Return To Work Payments, etc.) are configured under Employees >> Allowances/Deductions >> Bonuses.

They can then be edited individually on pays via Pays >> Edit Pay >> Edit (beside Bonus/Commission).

Cents Are Included

Traditionally, when reporting to the ATO cents have been truncated/dropped. With this STP2 update you will notice that exact amounts are now being reported to the ATO, including cents. The End of Year section still truncates cents in the old way, so that payment summaries remain unchanged.

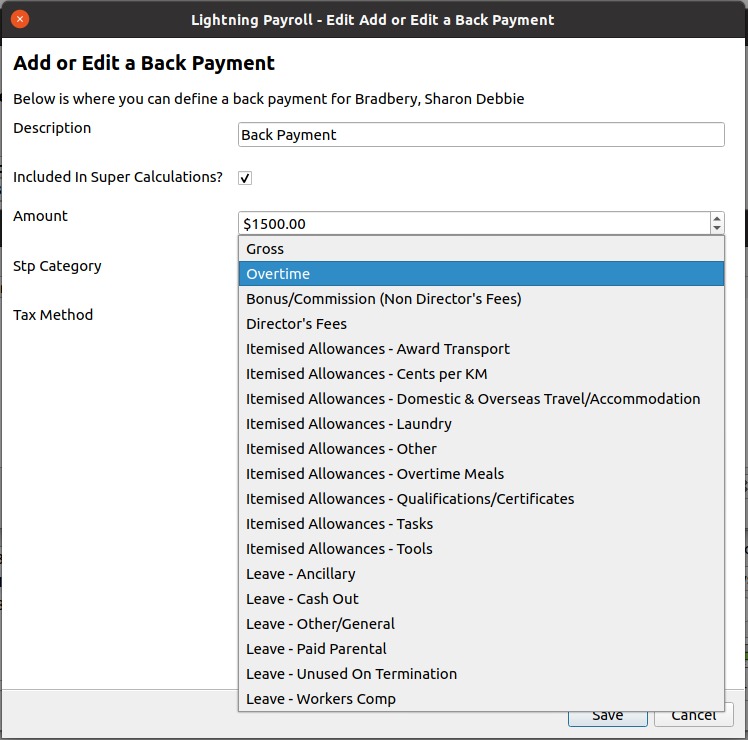

Back Payment Classification

Back payments must now be marked with a valid disaggregated gross category. This is a simple matter of choosing the right classification from the dropdown menu.

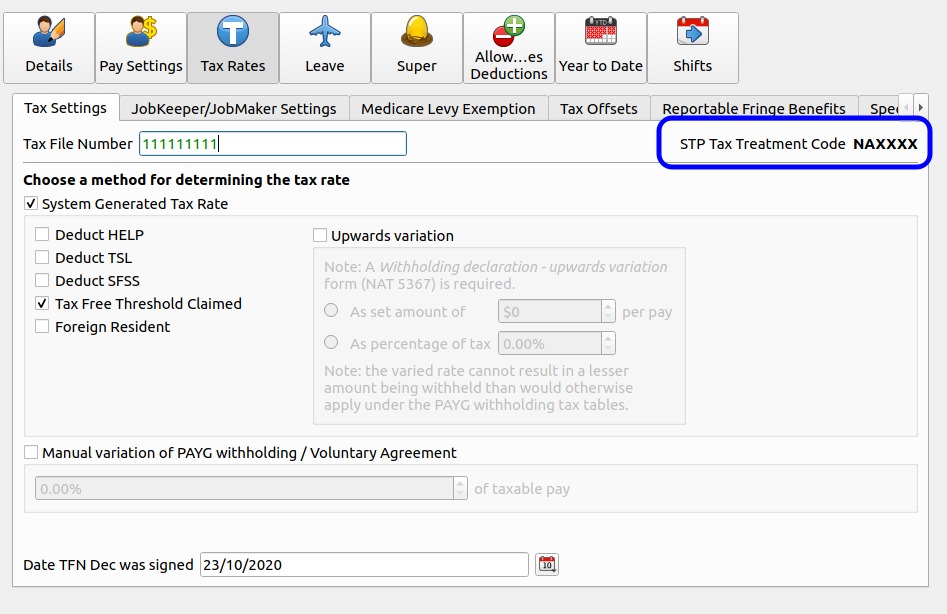

Employment and Taxation Conditions

In the past, Lightning Payroll would provide an option to include an employee's TFN declaration info (tax/employment settings) in the next new STP submission. STP Phase 2 now always includes this information by default, so there is nothing extra you need to do. It is most noticeably communicated via the new STP Tax Treatment code shown under Employees >> Tax Rates >> Tax Settings.

Income Types (Aka. Income Streams)

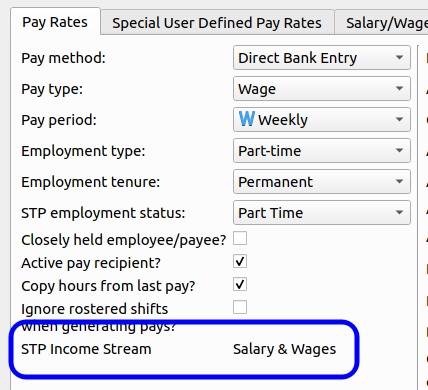

Lightning Payroll has been approved by the ATO to handle the four following STP 2 income streams. These income streams are set as a side-effect of configuring an employee's general settings. An employee's income stream is visible under Employees >> Pay Settings >> Pay Rates.

- Salary and Wages

- Most common, default income stream.

- Closely Held Payees

- Set by ticking Employees > Pay Settings >> Pay Rates >> Closely Held Payee?

- Working Holiday Makers

- Set by activating the Working Holiday tax scale under Employees >> Tax Rates >> Special Tax Rates.

- Voluntary Agreement

- Set by ticking Manual variation of PAYG withholding/Voluntary Agreement (and including a valid ABN) under Employees >> Tax Rates >> Tax Settings.

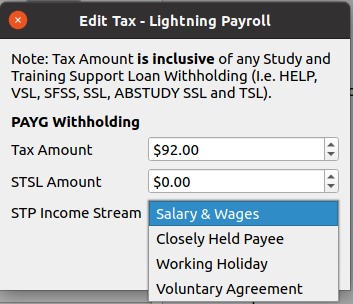

When completing a pay it will use an employee's income stream at that time. You can view or edit the income stream of an individual pay via Pays >> Edit Pay >> Edit (beside Tax).

Built-In Leave Types

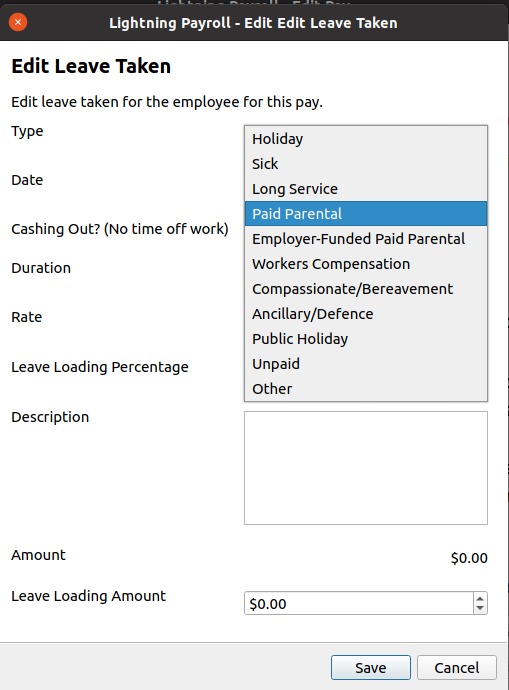

When an employee is on leave you will now be able to select from a broad range of leave types. Each type is mapped directly to a specific STP 2 reporting category.

Removal of Pre-Tax Deductions

Pre-tax deductions are not able to be reported through STP2, so they are no longer possible to be entered into Lightning Payroll. We have found that most users were using these pay items to either:

- reverse overpayments made to employees, or

- handle salary sacrifices.

If you've used these pre-tax deductions throughout the financial year these will have been converted to negative backpayments automatically. This would suit the recouping of overpaid funds to an employee.

If you were using pre-tax deductions for salary sacrifices, it is recommended that you convert these items to a dedicated salary sacrifice pay item for the whole financial year which can be configured under Employees >> Pay Settings >> Salary/Wage Sacrifice and then controlled via Pays >> Edit Pay >> Sacrifice (on the right hand side). This will ensure that the amounts are correctly reported via STP2 as a salary sacrifice, since these are now reportable to the ATO.

Country Codes (Working Holiday Maker Change)

For Working Holiday Maker employees you will need to set their home country under Employees >> Tax Rates >> Special Tax Rates. Lightning Payroll will request this when sending STP 2 for the first time.

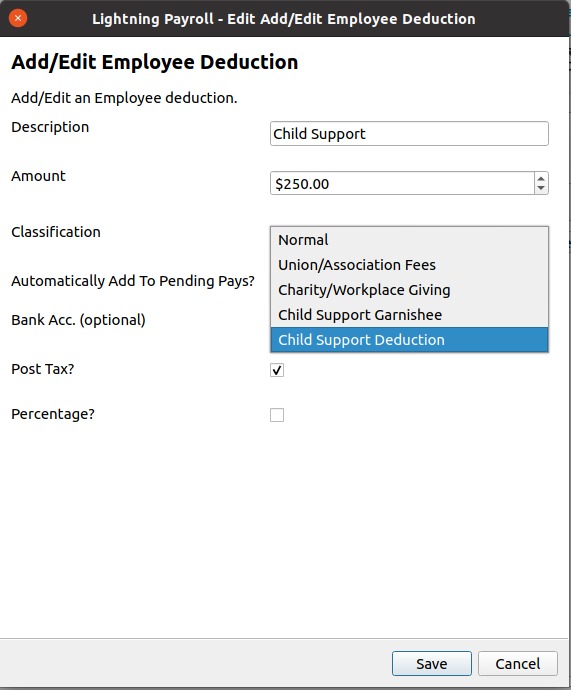

Child Support Deductions

Lightning Payroll has included classification of STP 2 child support deductions (garnishee and standard deduction types) for several months now, editable under Employees >> Allowances/Deductions >> Deductions. These classifications and amounts are now able to be reported to the ATO via STP2. If you do not wish to report child support deductions or garnishee amounts, just set the deduction classification to Normal under Employees >> Allowances/Deductions >> Deductions. If you need to change deduction classifications on past pays we recommend you use our Retrospective Tool under the Tools menu at the top of the screen.

Reporting Previous Business Management Software IDs and Payroll IDs

Occassionally - though very rarely - it may be necessary to report changes in employee IDs and company BMS IDs. This might occur when you've changed your business structure or changed software and can't zero out or finalise previous records. You can now view and edit (not recommended) these employee and BMS IDs under Employees >> Details and Company >> Details, respectively.

Time In Lieu

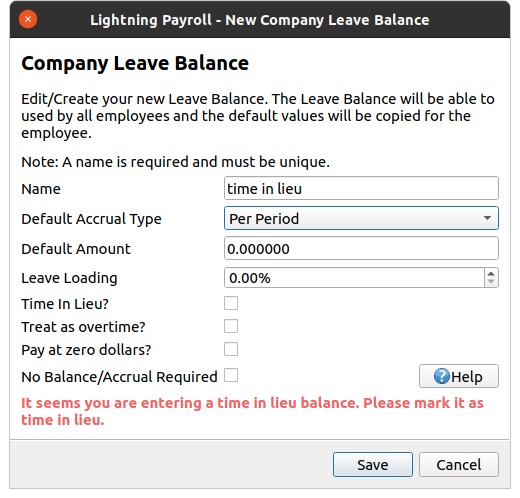

When recording a time in lieu custom leave item you will now need to mark it as such under Company >> Leave Balances so that it can be reported correctly through STP2. Time off in lieu (TOIL) is considered overtime when cashed out, and will be reported as such in STP 2.

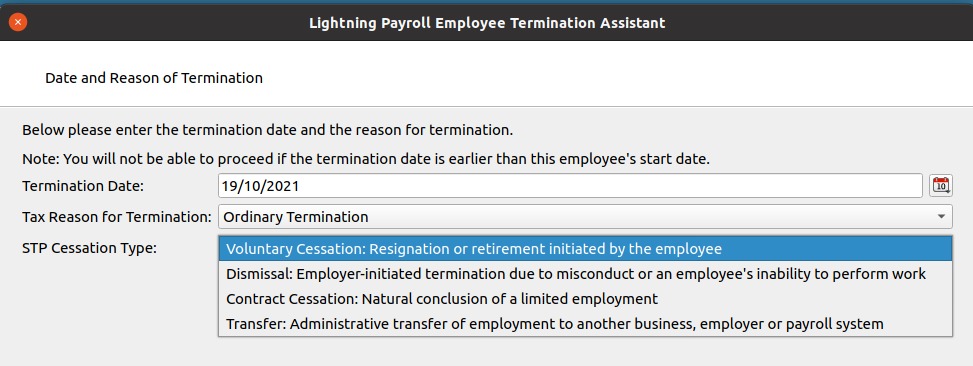

Termination Reasons

When terminating an employee you will now notice a new dropdown box where you can specify the detailed reason why an employee is being terminated. This may reduce the need for the ATO and Services Australia from requiring an employment separation certificate.