Answer

Prior to Lightning Payroll version 2021.5.0, when it came to applying a tax scale or assigning a financial year to a pay, the program was designed to use the pay period's end date over the pay's processing date. We have updated this to simplify and automate YTD calculations used for Single Touch Payroll so that less errors and headaches would occur at EOFY. The processed date for a pay refers to the date when payment is made to an employee.

Why Is The Pay Processed Date Important?

The date of payment is important to Fair Work Australia as it must be included on every payslip, however its main importance relates to the ATO with tax and YTD calculations. The ATO states that a financial year's payments are not about what pay runs end between July 1 and June 30, but what payments are made or processed within those dates.

"If salary and wages are accrued in the current financial year (prior to 30 June) but paid in the following financial year (on or after 1 July), the full amount of the payment will be taxed at the following financial year's tax rates and included in the following financial year's payment summary."

Older versions of Lightning Payroll required that financial year boundary dates be stretched or contracted so that the pays processed would be attributed to the right financial year. This is now automatic and rests solely on the processed date of pays entered into the program, so please be mindful of how processed dates work (see below) and that they are accurate.

How Are Pay Processed Dates Set In Lightning Payroll?

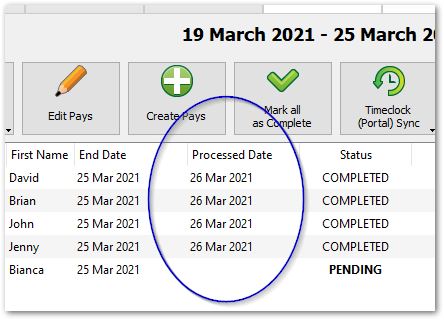

Pay processed dates are most prominent in the centre of the main Pays screen table (above), and they are controlled in a number of ways within the software:

- Automatically, when completing/saving a pay: The date that you first process and save a pay sets the initial processed date of the pay. In other words, when the pay changes status from Pending to Completed.

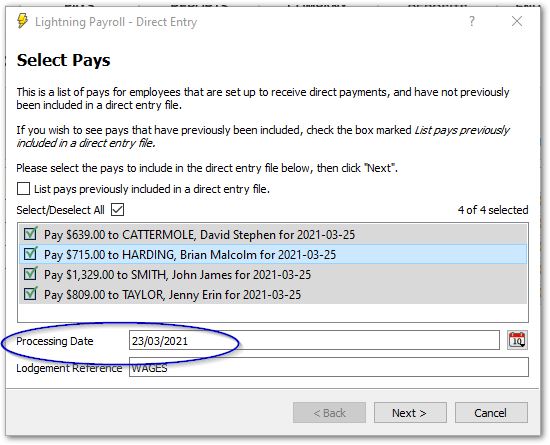

- Automatically, when creating a direct entry payment file: The processing date used in a direct entry file will automatically update the processed date of all pays included within the file.

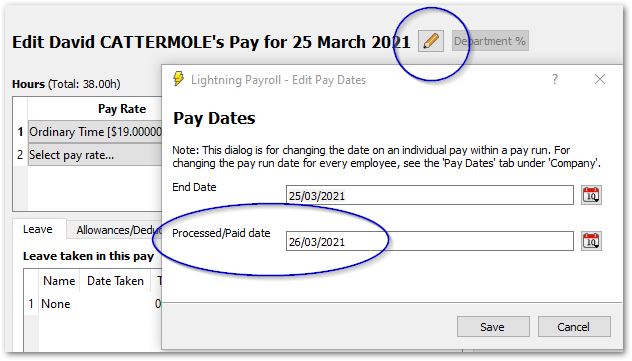

- Manually, for a single pay: You can edit an individual pay's processed date using the pencil button at the top of the Edit Pay window.

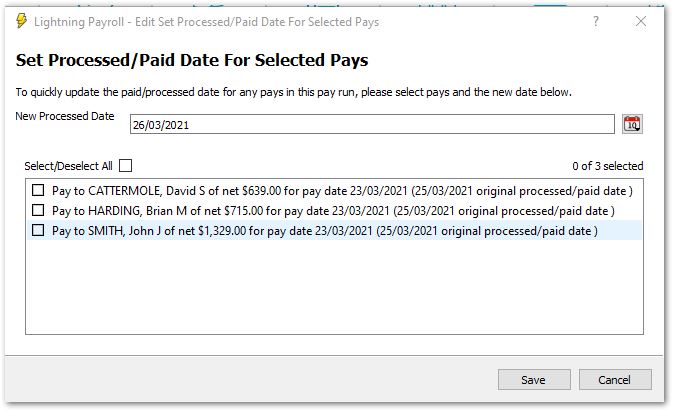

- Manually, for multiple pays in a pay run: You can edit the processed date for an entire pay run at the bottom of the main Pays screen, using the Set Processed/Paid Date For Pay Run button. Just enter the new processed date, and select the pays you wish to change the date for and click OK.

What If I Prefer The Old Pay Run Date Program Behaviour?

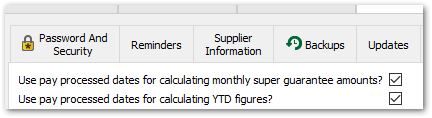

If you would like the program to operate as it used to, using pay run end dates to collect YTD amounts used for STP and payment summaries, you may. Just go into Settings >> Display/Time Settings and untick the box which says Use pay processed dates for calculating YTD figures?.

Do Reports Use Processed Date Or Paid Date?

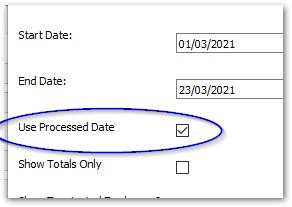

When running reports in the software you will often get the choice between selecting pay info based on pay run end date or processed date. Simply tick to Use Processed Date or untick to go by pay run end date when in the report form. Lightning Payroll will remember your preference for each report individually.

Please see this detailed FAQ on the Use Processed Date tickbox used for reports.

Can Financial Year Dates Be Edited?

If you would like to edit financial year boundary dates (to further control which financial year captures which pays) you can do so under Company >> Financial Years. See our FAQ on the topic for more information.