Answer

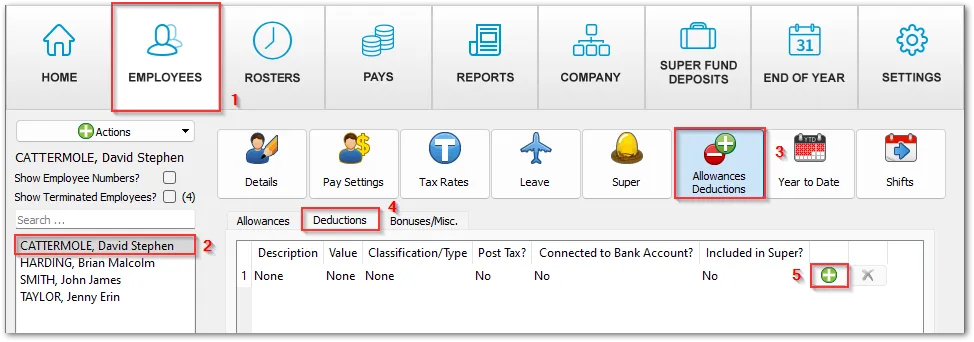

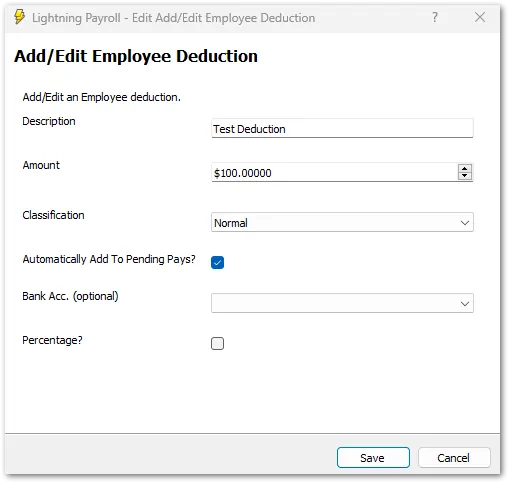

To setup a deduction for an employee go to the Employees tab >> Select the Employee on the left hand side >> Click on Allowances & Deductions >> Deductions >> Click on the green plus symbol to add the deduction & Save.

This deduction can then be seen in the Pays tab >> Edit Pay for this employee >> Click on Allowances/Deductions >> Deductions. You can edit the amount manually by clicking on the pencil icon.

A common type of deduction is a child support payment. If you mark a deduction as a child support payment it will check the minimum protected earnings amount against the net before allowing you to save the pay. These protected earnings amounts are updated each January.

You can also link a deduction to a secondary bank account for an employee (entered under Employees >> Details >> Bank Accounts). This would then include the deduction in an additional line entry within the direct entry banking file. If you are linking a deduction to a bank account, you will likely not need an amount entered against the account itself, under Employees >> Details >> Bank Accounts.

Note: If the deduction is required in a past completed pay, you will have to unlock that pay by clicking on the padlock in the bottom left hand corner. Then click on Allowances/Deductions >> Click on the green plus symbol under Deductions & Save.