Answer

Adding a Self Managed Super Fund (SMSF) to Lightning Payroll

To add a self managed super fund to Lightning Payroll:

- Navigate to Settings > Super Fund Providers

- Click on Create Super Fund (SMSF/Manual Entry)

- Select Self Managed Super Fund from the Type dropdown

Business Directors and SMSF Contributions

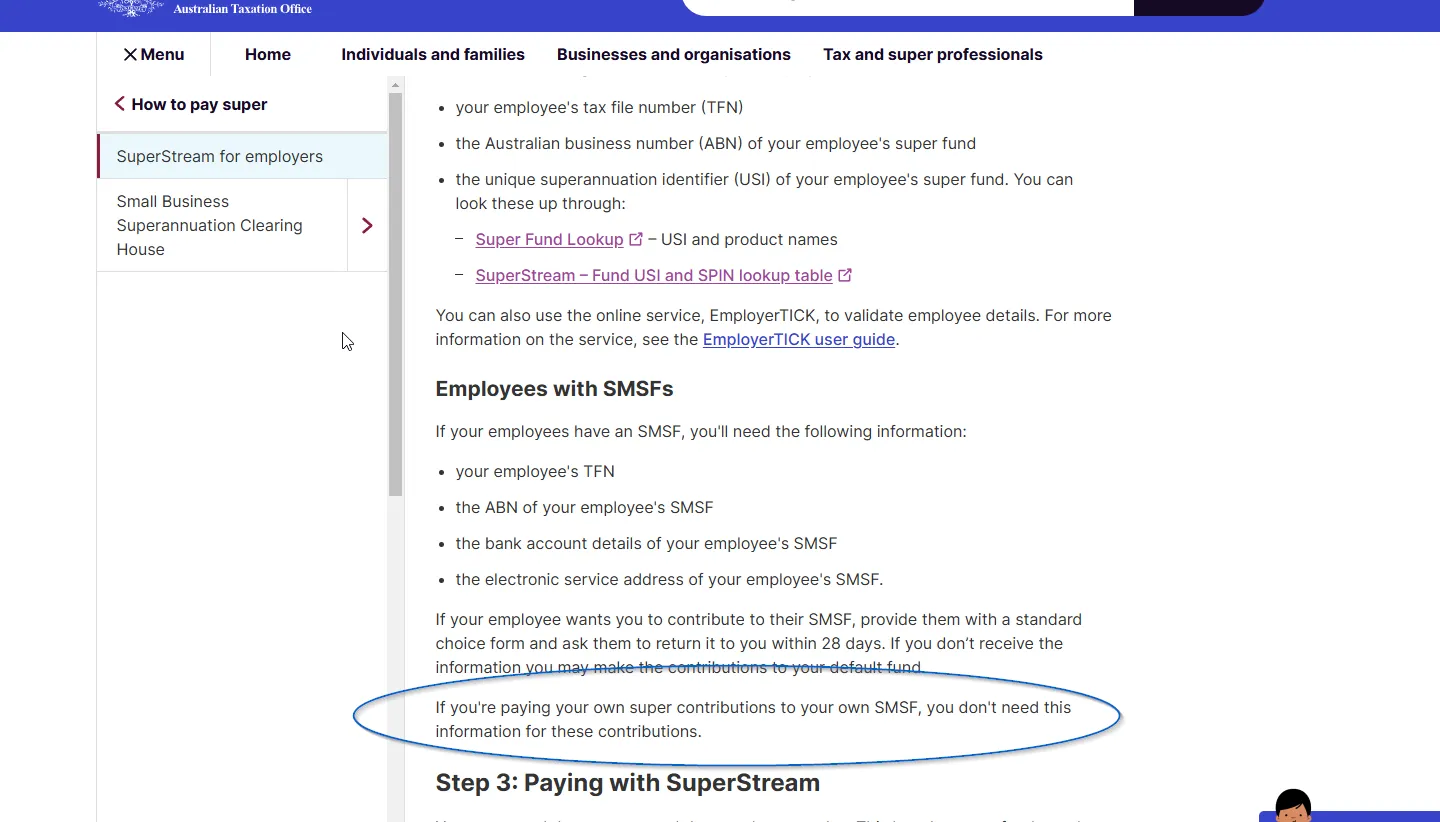

The Australian Taxation Office (ATO) provides specific guidance for business directors managing their own superannuation:

"If you're paying your own super contributions to your own SMSF, you don't need this information for these contributions."

This means that when you are a business director making direct contributions to your own Self Managed Super Fund, the SuperStream messaging requirements outlined below may not apply to your personal contributions.

Additionally, the ATO provides an example where contributions to an SMSF from a family business may also be exempt from SuperStream messaging requirements:

Example 2: SMSF Receives Contributions Only From Family Business

SuperSavings SMSF has been established for your family, and all members of the SMSF are either owners or employees of the family business. No members receive contributions from other employers.

Because of the direct link between ownership of the family business and membership of the SMSF, the SMSF meets the related party exemption. This means the SMSF doesn't need to receive contributions sent using SuperStream.

Your family business also has other employees who belong to other super funds. Your business will need to use SuperStream to send employer contributions to their funds.

For more information, visit the ATO's examples for SMSFs and SuperStream page.

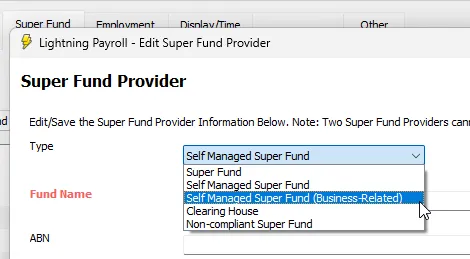

Handling Business-Related SMSFs in Lightning Payroll

If your business is paying contributions into an SMSF that is related to the business, such as one belonging to a director or owner (rather than an unrelated employee), Lightning Payroll provides a specific fund type to handle this scenario.

To categorise an SMSF as business-related:

- Navigate to Settings > Super Fund Providers

- Edit the relevant SMSF

- Change the Type from Self Managed Super Fund to Self Managed Super Fund (Business Related)

This setting tells Lightning Payroll that the SMSF belongs to a business-related party, such as a director. As a result:

- No SuperStream messages will be sent to this fund

- The fund's contributions will still be included in the SuperStream

.aba(bank file) alongside other employee contributions

This reclassification helps avoid unnecessary SuperStream error messages while maintaining accurate and complete payment records.

SuperStream Messaging Requirements

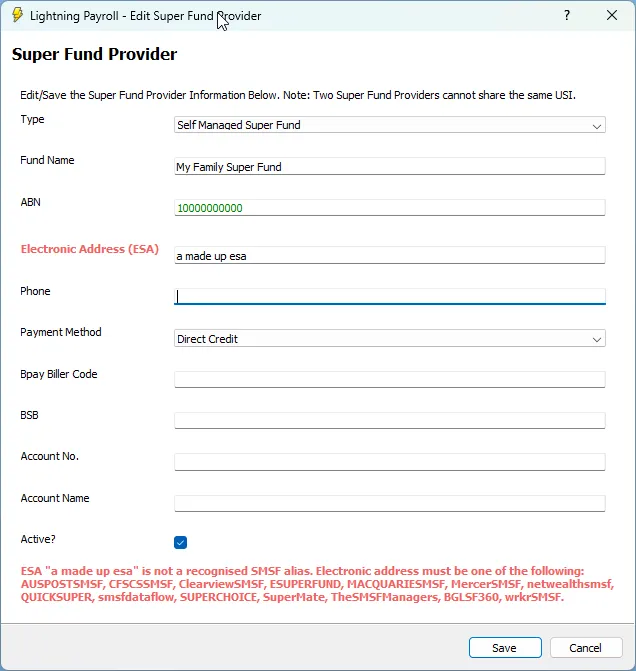

When setting up a Self Managed Super Fund for employees, there are important messaging requirements to be aware of:

Electronic Service Address (ESA)

To send SuperStream messages, you will need to input an electronic address (aka. electronic service address or ESA). This is crucial for correctly routing SuperStream messages for the fund. The person with the self managed fund should be able to provide this electronic service address.

Employee SMSF Messaging Provider

Employees will need to have a SMSF messaging provider connected to their SMSF to receive SuperStream messages from the national super network. For a comprehensive list of SMSF messaging providers, please refer to the ATO's register of SMSF messaging providers.

SuperStream Response Messages

Lightning Payroll will automatically download any SuperStream responses, though these are not very common (only about 1 in 50 messages generate a response). Responses typically occur when there is an error or when a new employee account is registered, such as in the case of a new member registration message.

If a response is received from the super fund, an email will be sent to the main registered account email address. This email will include a PDF attachment containing the super fund's response message. It is important to review these responses promptly to address any issues.

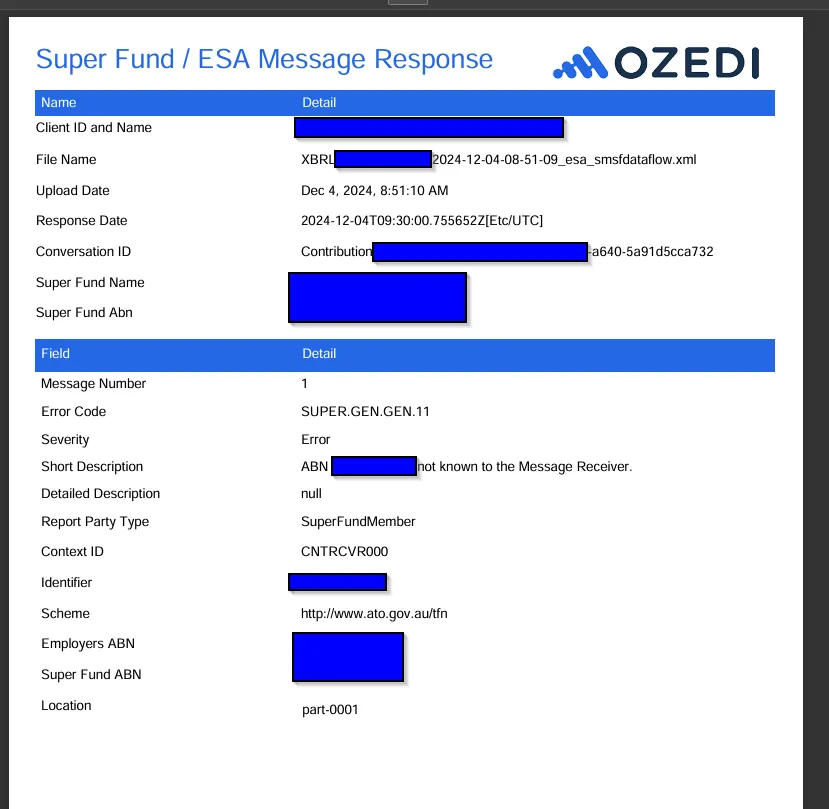

Common SMSF SuperStream Error

The most common issue encountered is an error indicating that the SMSF does not have an account set up with an SMSF messaging provider. This can result in rejection messages, as illustrated in the example below:

For business directors, it is important to note that contributions to their own SMSF do not require SuperStream messages. Directors should avoid sending SuperStream messages for their own contributions, as this is unnecessary and can generate error responses.

If the SMSF belongs to an employee and does not have a messaging provider, you will need to help the employee set up an account with a registered provider from the ATO's list. Failure to fix this issue will result in continued error response emails if contributions are repeatedly attempted without a valid SMSF messaging provider account associated with the provided ESA.

Additional Resources

For a detailed overview of SuperStream requirements, including how it applies to employers, visit the ATO's SuperStream for Employers page.