Answer

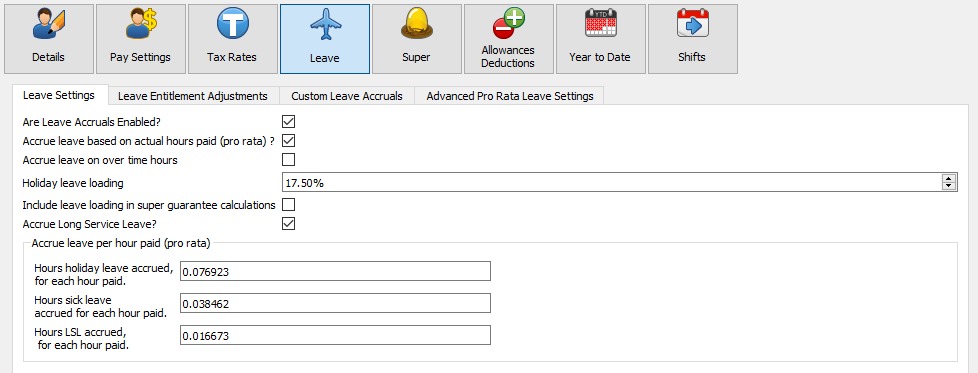

Long Service Leave (LSL) accrual rates can differ across Australian states and territories due to varying legislation. Awards may also define a year as either 52 weeks or 52.1667 weeks, depending on their specific wording. When no specific weekly interpretation is provided, 52.1667 weeks per year is often used. This can slightly affect the default pro-rata accrual rates in your payroll system.

Below are examples demonstrating how to calculate a pro-rata hourly accrual rate for LSL using the 52.1667-week year for Queensland (QLD), Victoria (VIC), and the Northern Territory (NT).

Step-by-step Calculation

-

Determine the target LSL hours per year for a full-time employee:

- Queensland (QLD): Employees accrue 8.6667 weeks of LSL every 10 years. Annually, this equals

8.6667 ÷ 10 = 0.86667 weeks. Multiplying by 38 hours per week gives0.86667 × 38 = 32.93346 hoursper year. - Victoria (VIC): LSL accrues as

33.144 hours per year. - Northern Territory (NT): LSL accrues as

49.4 hours per year.

- Queensland (QLD): Employees accrue 8.6667 weeks of LSL every 10 years. Annually, this equals

-

Calculate the total hours worked annually for a full-time employee:

- Weekly hours:

38 hours - Annual weeks:

52.1667 weeks - Annual hours:

38 × 52.1667 = 1982.3346 hours

- Weekly hours:

-

Apply the formula to calculate the hourly LSL accrual rate:

Results:Hourly rate = LSL hours per year ÷ Annual hours worked- QLD:

32.93346 ÷ 1982.3346 = 0.016613(rounded to 6 decimal places) - VIC:

33.144 ÷ 1982.3346 = 0.016720(rounded to 6 decimal places) - NT:

49.4 ÷ 1982.3346 = 0.024920(rounded to 6 decimal places)

- QLD:

Summary Table

| State | Annual Target Hours (LSL) | Hours Worked Annually | Hourly LSL Accrual Rate |

|---|---|---|---|

| QLD | 32.93346 | 1982.3346 | 0.016613 |

| VIC | 33.144 | 1982.3346 | 0.016720 |

| NT | 49.4 | 1982.3346 | 0.024920 |

By using this method, you can calculate custom pro-rata LSL accrual rates for any state or award using the appropriate target hours and weekly interpretations.