Answer

When an employee attends Jury Duty, they are usually paid by the court. In many circumstances, they are eligible for make-up pay. Fair Work Australia describes eligibility and make-up pay here.

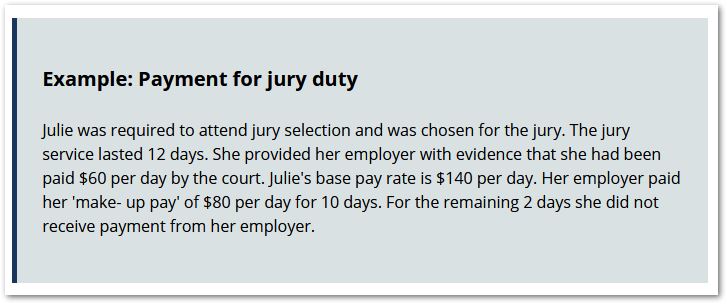

The image below is an example they provide:

Make up pay should be entered as leave taken in this pay under the leave type 'Ancillary'.

In their STP Phase 2 Disaggregation of gross position paper, the ATO writes:

"Employers may offer paid or unpaid absences for all these types of leave. All paid absences,

including “make-up pay” for ancillary and defence leave are to be reported as Paid Leave

Type–A (Ancillary and Defence Leave). These types of absences are not ordinary time

earnings or salary or wages for superannuation guarantee purposes.

Any other types of paid absences that are not OTE are to be reported under this category."