Answer

If you need to make an incentive, sales commission, Director's Fees, Return to Work payment, or any other miscellaneous gross payment to an employee, this can be done as a bonus in the program.

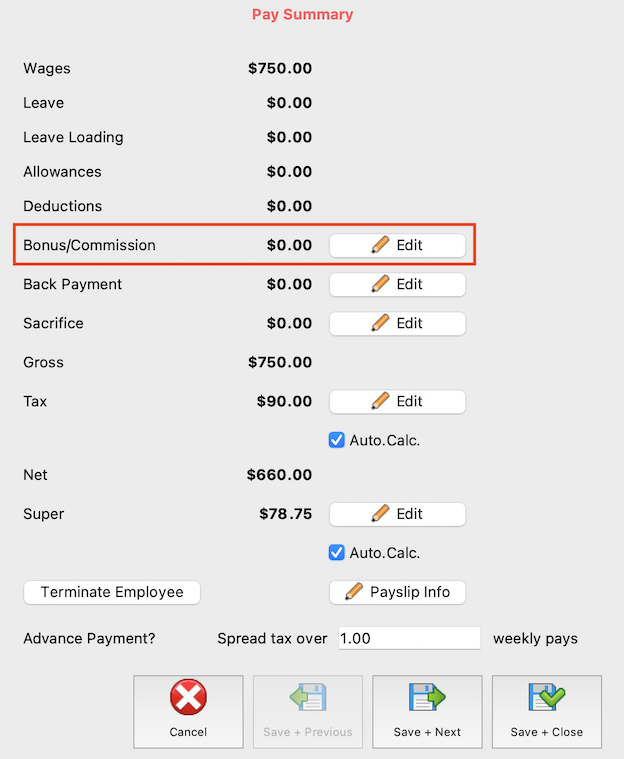

If you are happy to use the label Bonus/Commission, you can edit a bonus directly in-pay by going to the pay run in question, clicking the pencil to edit the employee's pay, then clicking Edit to the right of Bonus/Commission on the right-hand side of the Edit Pays screen.

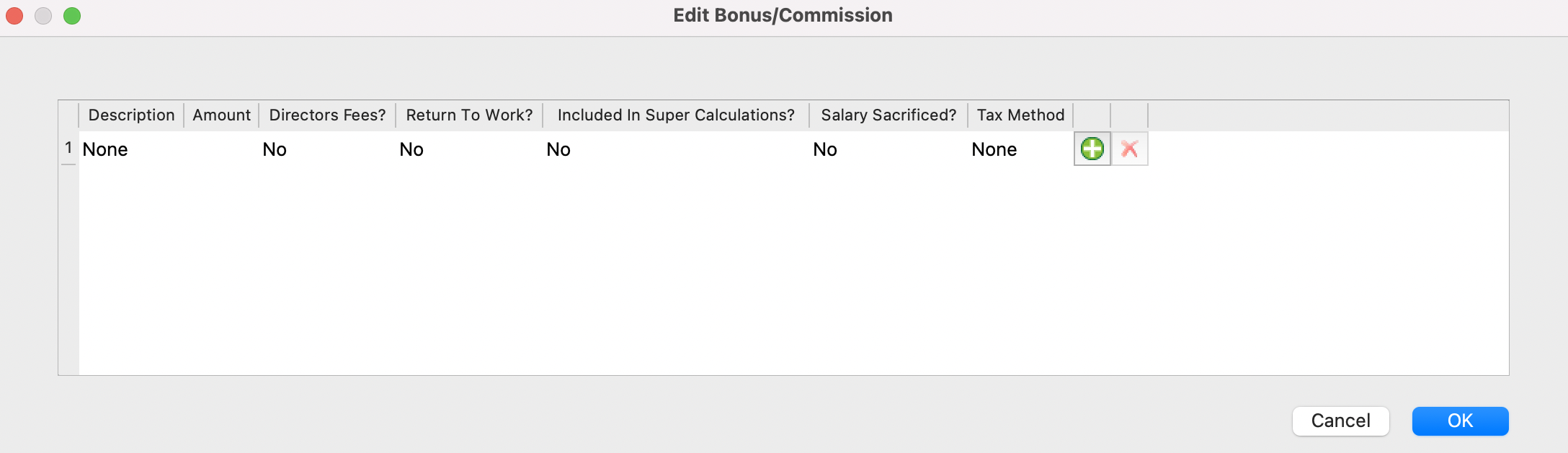

Use the plus+ symbol seen to the right to add the bonus into the pay.

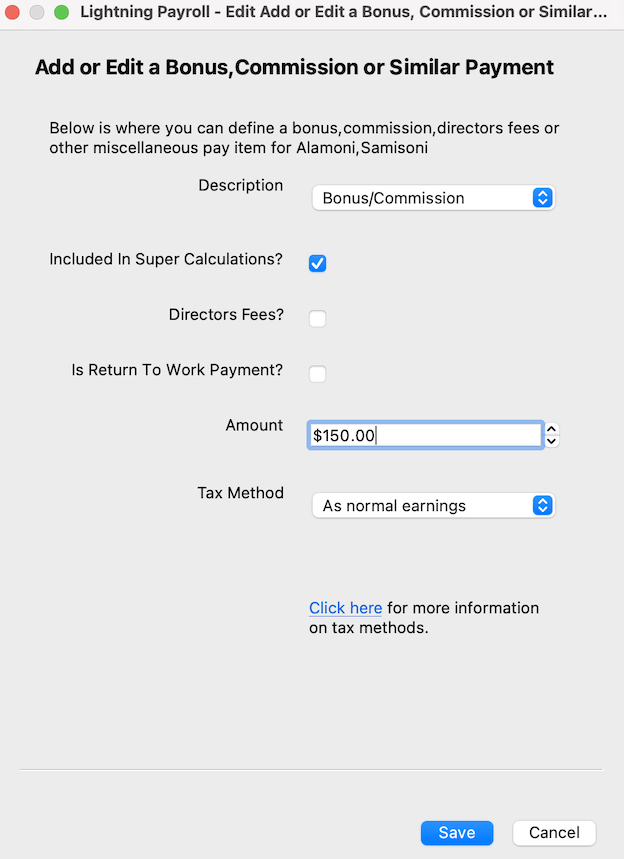

Finally, enter the bonus amount and select a tax method from the available ATO options; the date fields are only enabled when a relevant tax method is selected. Here you are able to nominate the payment as Director's Fees or a Return to Work payment, if relevant, as well as nominate whether the amount will be included in super calculations.

If you would like to change the description from Bonus/Commission to something more personalised, you first need to create the bonus item via Employees >> Allowances/Deductions >> Bonuses in the program, then follow the steps above to add the newly-named bonus into the pay/s.