Answer

Lightning Payroll can warn you before paying above the super concessional cap, to help employees avoid paying excess tax.

"Concessional contributions are made into your super fund before tax, and include:

- employer contributions, such as

- compulsory employer contributions

- any additional concessional contributions your employer makes

- salary sacrifice payments made to your super fund

- other amounts paid by your employer from your before-tax income to your super fund, such as administration fees and insurance premiums

Once the concessional contributions are in your super fund, they are taxed at the 15% rate. There are caps on the concessional contributions you can make each financial year. If you go over the cap, you may have to pay extra tax."

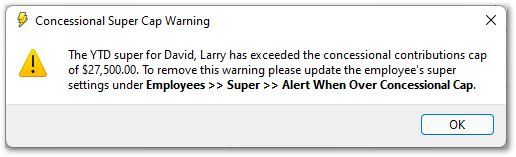

Lightning Payroll includes a setting to help monitor this cap under Employees >> Super >> Superannuation Contributions >> Alert When Over Concessional Cap? by ticking this box the program will alert you whenever the employee's super has exceeded the cap for a given year.

From 1 July 2021 the general concessional contributions cap is $27,500 per year, regardless of your age.

This alert will appear when you try to Save & Close an employees Pay who has gone over the cap.