Answer

Leave accruals in Lightning Payroll can be controlled by configuring an individual employee's settings under Employees >> Leave >> Leave Settings. Accruals can be made to occur by the pay period or by the hours worked (pro-rata).

Note: Lightning Payroll applies the most common accrual settings when a new employee is created, based on the given STP employment status. Leave settings should be carefully considered to suit your employee's state and award. Each state has different LSL rules and each award can have its own particular requirements such as annual leave loading or differing entitlement days per year. While LP can assist in LSL payouts, LSL amounts often need to be calculated manually. An example of a complex difference in LSL can be seen here.

Accrue by Pay Period

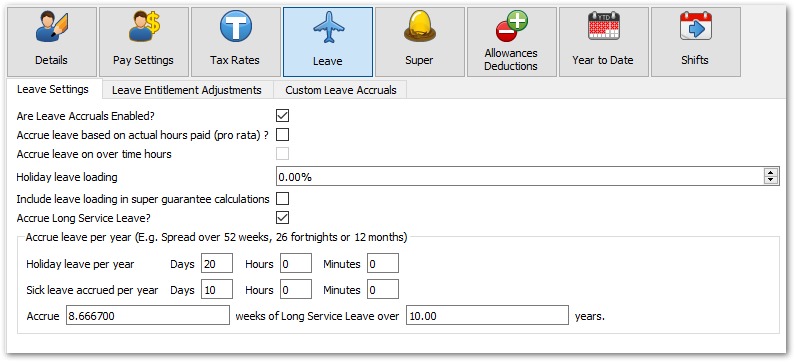

A typical full-time employee's settings might look like this. In this example, the employee does not get annual leave loading.

This employee accrues 20 days holiday leave and 10 days sick/personal leave as per the Fair Work National Employment Standards.

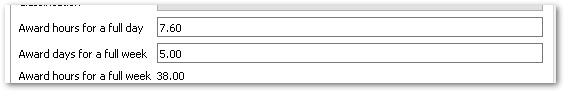

How many hours per day this calculates is based on the employee's award hours for a full day. These are configured under Employees >> Pay Settings.

The formula used by Lightning Payroll to calculate accruals for one pay run in this scenario would be:

days of leave entitlements per year x award hours per day / pays per year

E.g. A weekly full-time employee would accrue:

Annual - 20 days X 7.6 hrs / 52 weeks = 2.92307 hours p/wk

Personal - 10 days X 7.6 hrs / 52 weeks = 1.46153 hours p/wk

Long Service Leave is slightly different as it is usually required to accrue by weeks per 7, 10 or 15 years.

In this case, with the 'per pay period' leave settings displayed in the above picture, it would calculate:

(8.6667 weeks p/yr X 38 hours p/wk) / 10 yrs / 52 weeks = 0.6333 hours p/wk

Accrue by Hours Paid (Pro-Rata)

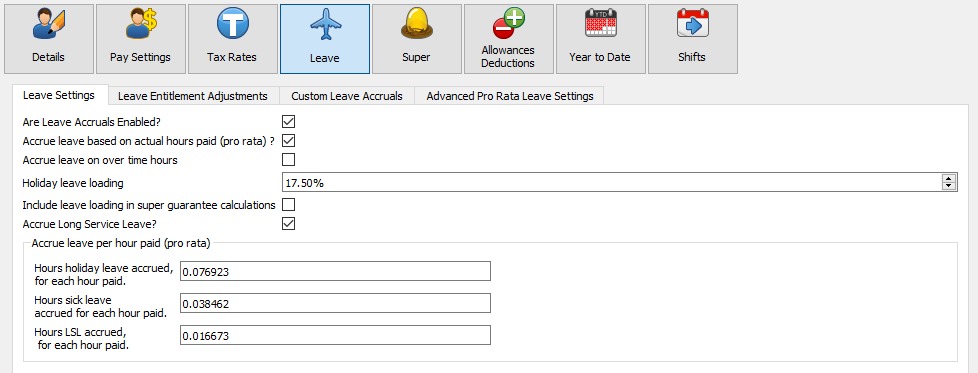

A typical part-timer with pro-rata annual leave accruals would look like this:

Their pro-rata leave accruals are controlled based on the Hours leave accrued, for each hour paid fields.

This decimal value would accrue the same result as above if a part-time employee worked 38 hours per week.

For example:

Annual - 38 hrs X 0.076923 = 2.92307 hrs

Personal/Sick - 38 hrs X 0.038461 = 1.46153 hrs

Long Service - 38 hrs X 0.016673 = 0.633574 hrs

Sometimes you might need to calculate a pro rata amount manually. See our next FAQ on pro rata accrual rates for a more detailed explanation of how these work and how to change them to a special situation.