Answer

Lightning Payroll offers a feature that allows you to link a salary sacrifice to a bonus, which is useful for managing how taxes are calculated on different components of an employee's pay. This guide explains how to use this feature and illustrates the difference in tax calculations depending on whether the bonus and salary sacrifice are linked.

Understanding the Basics

When processing payroll that includes both a bonus and other regular pay items, it's important to understand that two tax scales can be used concurrently:

- Normal Tax Table: This applies to regular pay items.

- Method A or B: This specifically targets the bonus amount.

Linking the Bonus and Salary Sacrifice

Linking a salary sacrifice to a bonus changes how the bonus is taxed. Here???s what happens:

- If the bonus and sacrifice are linked: The amount of the bonus is reduced by the salary sacrifice before tax is applied. Thus, tax is calculated on the reduced bonus amount using Method A or B.

- If the bonus and sacrifice are not linked: The salary sacrifice is applied to the regular pay items first and the normal tax table is used to calculate tax on the reduced salary amount.

Example Scenario

Let's consider an employee receiving a $2000 bonus (taxed using Method B) and a regular salary of $2000 with a salary sacrifice of $500:

- Bonus and Sacrifice Linked:

- Taxable Bonus (Method B): $1500 ($2000 bonus - $500 sacrifice)

- Taxable Salary (Normal Scale): $2000

- Bonus and Sacrifice Not Linked:

- Taxable Bonus (Method B): $2000

- Taxable Salary (Normal Scale): $1500 ($2000 salary - $500 sacrifice)

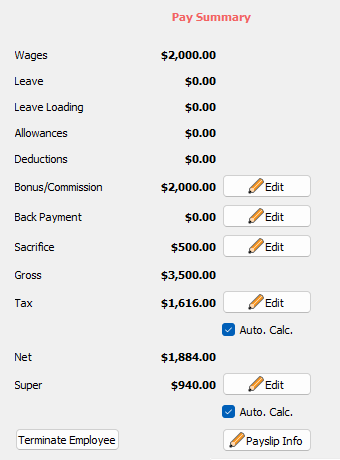

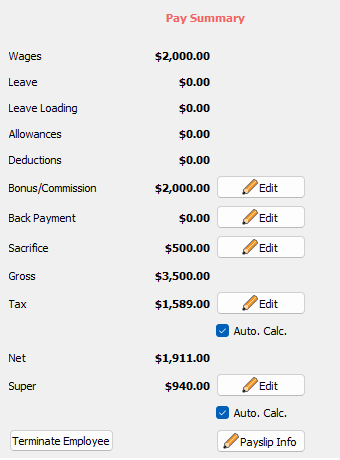

Here are some example images showing the tax implications. The first image displays a pay without the bonus and sacrifice linked, whilst the second image displays a pay that does. All other pay details are the same otherwise:

Although the difference might seem small, linking the bonus and the salary sacrifice generally results in less tax being applied as shown in the second image.

System Prompts

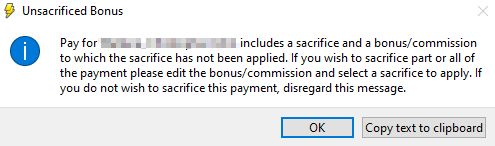

When saving payroll details in Lightning Payroll, if the system detects that the bonus and salary sacrifice are not linked, it will display a prompt. This prompt serves as a recommendation and can be ignored if the current setup meets your payroll needs. Here is what the prompt looks like:

Conclusion

This feature in Lightning Payroll ensures that you have the flexibility to manage payroll effectively while optimising tax obligations. Always consider how different configurations affect tax liabilities and choose the one that best suits your payroll requirements.