Answer

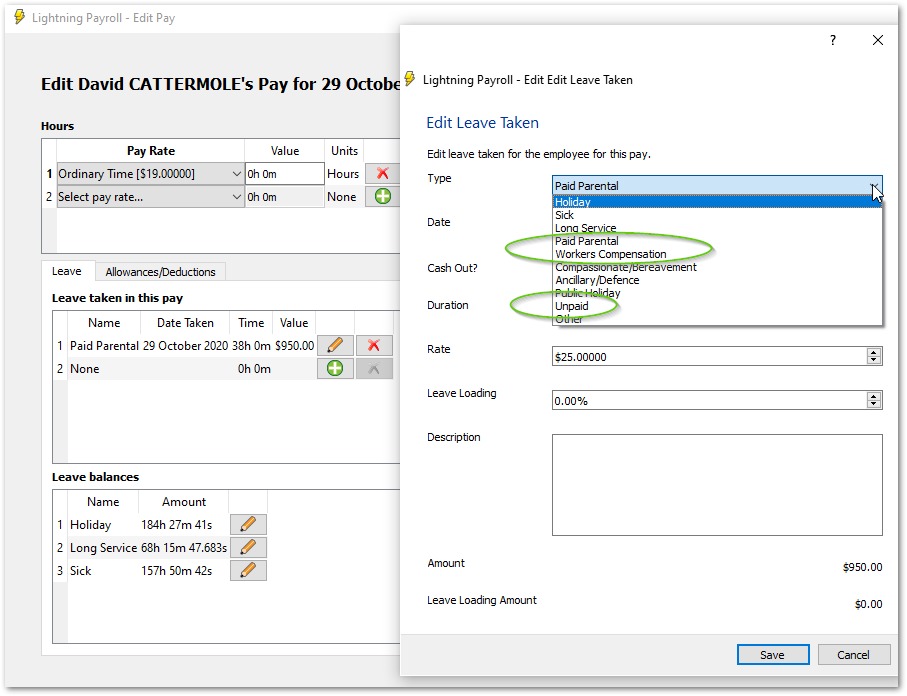

If an employee is on paid parental leave (commonly known as maternity leave), unpaid leave or on leave whilst receiving workers compensation, there are paid parental, unpaid and worker's compensation leave types that can be selected when processing pays.

You can select any of these options in the Leave taken in this pay section as shown below.

Once you have selected paid parental, unpaid or workers compensation, you can set the duration and the hourly rate for the leave.

For paid parental leave and workers compensation, if you only have a daily or weekly rate, you can calculate the hourly rate by dividing the dollar figure by the number of hours the employee normally works in a day or week respectively.

For example:

If you need to pay $1000 per week and the employee typically works 38 hours per week, the hourly rate would be $1000 / 38, or $26.32.

If you need to pay $150 per day and the employee typically works 8 hours per day, the hourly rate would be $150/ 8, or $18.75.

Lightning Payroll will remember this hourly amount (since it is unlikely to match their normal hourly rate), and save it automatically under Employees >> Leave >> Advanced pro rata leave settings, for the next time they receive this special leave type.

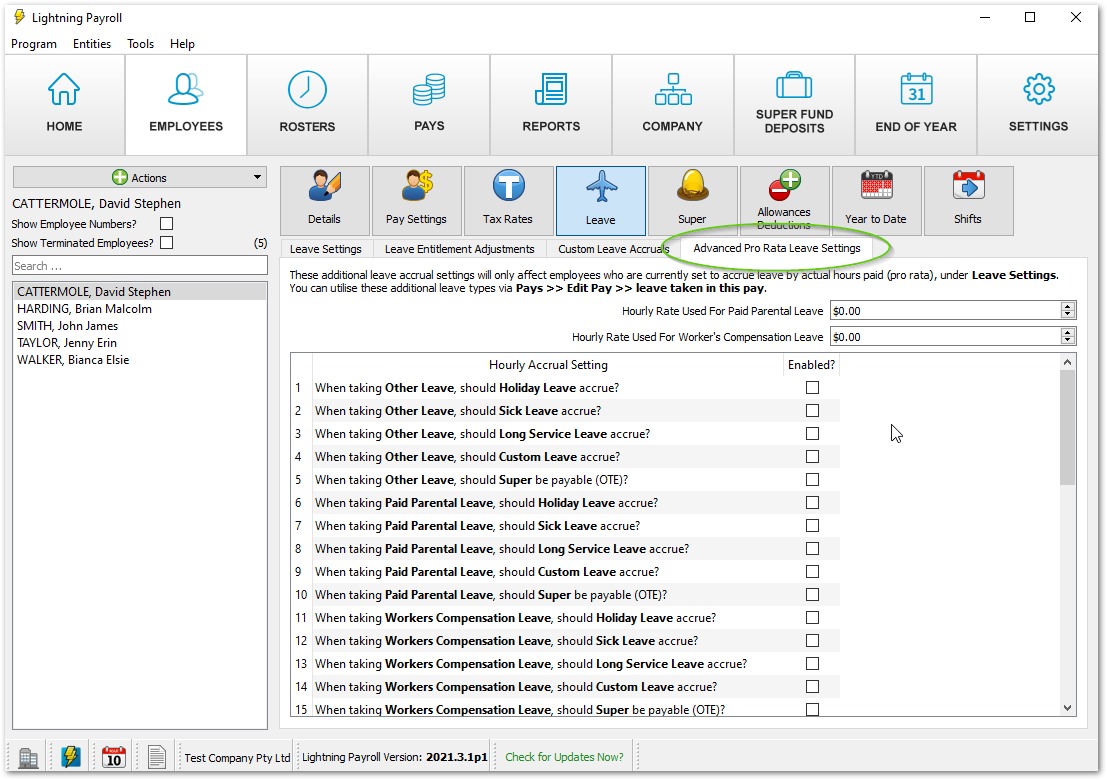

Super and Leave Accrual Settings

Paid parental leave, unpaid leave and workers compensation may or may not attract leave accruals and superannuation depending on your state legislation or industry awards.

If you need to adjust whether leave or superannuation accrues on paid parental leave or workers compensation, you can do this under Employees >> Leave >> Advanced Pro Rata Leave Settings.

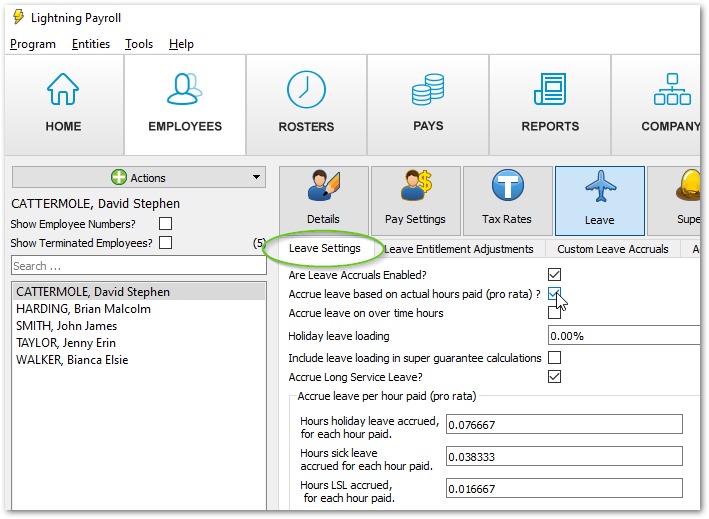

Note: If you're not able to select any of the advanced settings, it means the employee has not been set to accrue leave on a per hour paid (pro-rata) basis. You can turn this on under Employees >> Leave >> Leave Settings.