Answer

Below is some information on how to handle a change of ABN within Lightning Payroll.

Finalising For The Old ABN

Before changing details over to the new company, you'll want to ensure Single Touch Payroll and super payments have been sent off for the previous entity.

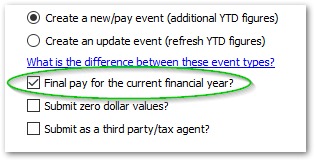

To finalise STP, just submit the final pay run to be paid from the previous ABN and when doing so, tick the box which says 'Final pay for the current financial year?'.

It is also recommended to finalise and pay any super owed from the old entity as normal now too, since sending super after updating the company details and ABN will result in the super coming from the wrong (new) entity.

Splitting & Restarting Financial Year YTD Amounts

If the company is changing ABN and/or ownership part way through a financial year, but all or most employees are remaining, you should split the financial year using the processed date of the final pay run to be made from the old company.

Example:

Company A's last pay is processed on November 10th (pay run start and end dates are not important).

Company B's first pay is to be processed one week later on November 17th.

You would split the financial year in Lightning Payroll to break on the 10th/11th.

Originally there would be one financial year (1/7 to 30/6).

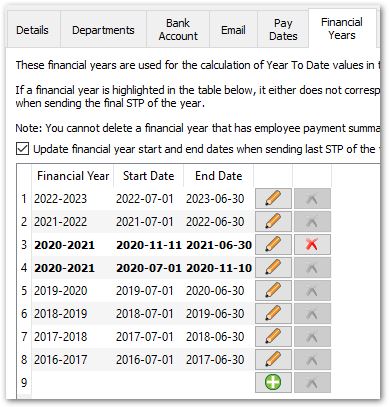

After splitting, there would be two (from 1/7 to 10/11 and from 11/11 to 30/6).

To split the financial year and allow two distinct YTD amount boundaries (one for each of the two companies), go to Company > > Financial Years.

Click the pencil button to edit the current financial year and change the end date to match the final pay processed date of the old company and click 'Save'.

Then, click the green plus button to add a second copy of the financial year in question. Set the start date to be the day after the previous FY block (that you've just edited) ends.

After following these steps, it should appear as below (should you be addressing the 2020 - 2021 Financial Year):

If the company is changing ABN and/or ownership at the beginning of a financial year, and all or most employees are remaining, you should finalise the pays, Single Touch and super under the current company, then update the business details in the Company >> Details section of the program.

In either of the above scenarios, please keep in mind you will need to add a new machine credential to your existing keystore file so that you can send off STP for the new ABN, as well as the old one, in the case you need to fix or resubmit any older data.

Updating ABN And Other New Entity Details

Finally, update the Company > > Details section with the new company details and ABN.

Please also report the new ABN to our support team so that we can register it for SuperStream messaging with our gateway provider. You can do this yourself if you wish, by logging into your Lightning Payroll website account. Do not remove the old ABN if possible since you may need to do a follow up super payment at some point. Just add the new ABN under My Account >> Superstream Registration (Additional Companies).