Answer

Lightning Payroll can automatically calculate Study and Training Support Loans (STSL) repayments for employees who have an outstanding education loan. This includes:

- Higher Education Loan Program (HELP)

- VET Student Loans (VSL)

- Student Financial Supplement Scheme (SFSS)

- Student Start-up Loan (SSL)

- Trade Support Loan (TSL)

How Are STSL Repayments Calculated?

STSL repayments are income-based and apply once an employee’s repayment income exceeds the minimum threshold set by the Australian Taxation Office (ATO). Employers must withhold additional amounts from employee wages to cover anticipated STSL repayments.

For the latest STSL repayment thresholds and rates, refer to the ATO’s official page: Study and Training Support Loans Repayment Thresholds and Rates.

Enabling STSL Withholding in Lightning Payroll

To ensure STSL repayments are withheld correctly, follow these steps in Lightning Payroll:

- Go to the Employees tab.

- Select the employee who has an STSL debt.

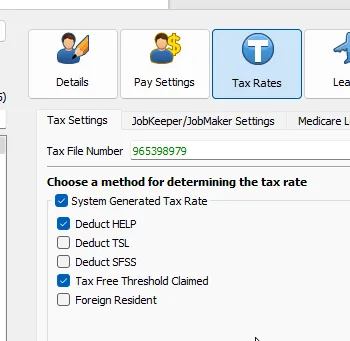

- Navigate to Tax Rates > Tax Settings.

- Tick any box labelled HELP/SFSS/TSL (they are all treated the same, as STSL).

- Save the changes.

Once enabled, Lightning Payroll will automatically apply the appropriate withholding based on the employee’s taxable income.

Does Lightning Payroll Adjust Repayments Automatically?

Yes, Lightning Payroll follows the ATO’s latest STSL tax scales and automatically adjusts repayments based on the employee’s earnings. If the ATO updates repayment thresholds, they will be reflected in the next tax table update.

What If an Employee No Longer Has an STSL Debt?

If an employee has repaid their STSL debt in full, they must notify their employer and update their tax declaration. To remove STSL withholding in Lightning Payroll:

- Go to the Employees tab.

- Select the employee.

- Navigate to Tax Rates > Tax Settings.

- Untick the HELP/SFSS/TSL box.

- Save the changes.

Further Information

For more details on STSL repayments, visit the ATO’s official STSL page: Study and Training Support Loans (ATO).

If you have any questions regarding STSL in Lightning Payroll, feel free to contact our support team.