Answer

When terminating an employee, the ATO uses the Unused Leave on Termination Tax Table when determining the amount of tax to take from their termination pay out.

There are many tax formulas and calculations that are running side-by-side when determining the amount of tax on a termination payment. Most termination amounts (unused holiday leave, leave loading and long service leave) are taxed using a Marginal Rate Formula.

We have developed a web application to assist with these calculations, and to give better understanding on the processes and steps undertaken within the program to provide the tax amounts on terminations. You can view this handy tool here.

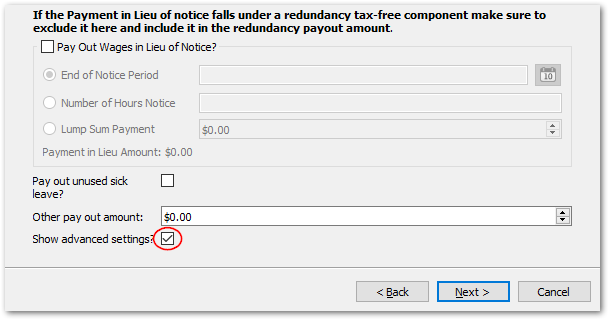

An important factor in a marginal rate calculation is the normal earnings value; if you are being provided with a very low amount, or no tax amount, on a termination pay out, this is likely due to the normal earnings value being inaccurate. Within the termination process (see here for a more detailed description on the termination process), you are able to view and adjust the normal earnings value by ticking the Advanced Settings option when reaching this page.

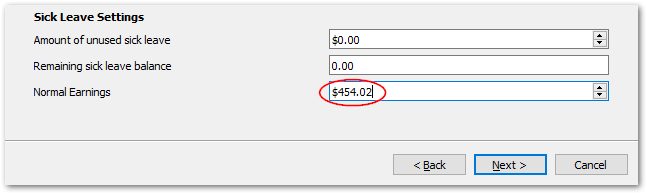

On the following page, when you click Next, you will be able to view/adjust the normal earnings value at the bottom as displayed below.

It is important to consider that this value does not generally need to be edited, as Lightning Payroll handles these calculations automatically by averaging out the pays over the financial year.