Answer

If you need to make a one-off top-up of RESC (Reportable Employer Super Contribution) before the end of the financial year (EOFY), there are two ways to do it. For most employers, Method 1 is more popular – creating an extra pay with RESC only – because it lets you pay the extra super now and leave the compulsory Super Guarantee (SG) until the July 28 due date.

Note: The July 28 SG due date only applies to the 2024–25 financial year. From July 1st 2026, the ATO’s Payday Super measure will require Super Guarantee amounts to be paid on payday.

Method 1 – Pay RESC Only

This method suits anyone who simply wants to pay the RESC amount before 30 June and leave June’s SG until the new financial year.

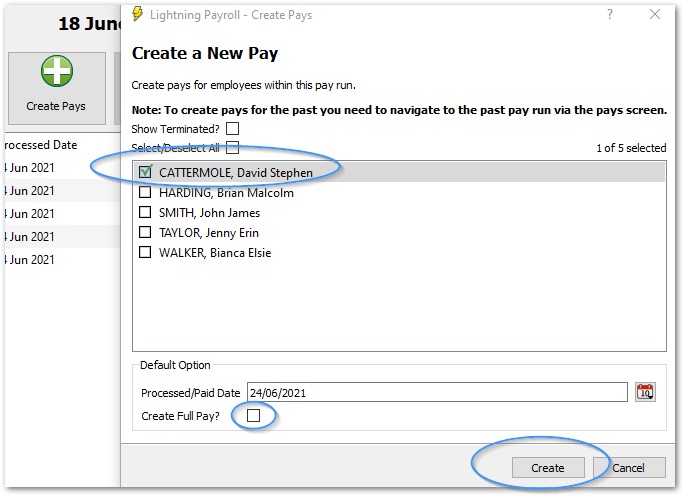

- Navigate to the desired pay run in Pays.

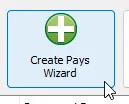

- Select Create Pays Wizard.

- Tick the relevant employees, then untick Create Full Pay?.

This creates an additional $0.00 pay for each employee.

- Edit each new pay and click Edit beside Super.

Enter the RESC amount only (leave SG at $0.00).

- Pay the contribution via the Payday Super section:

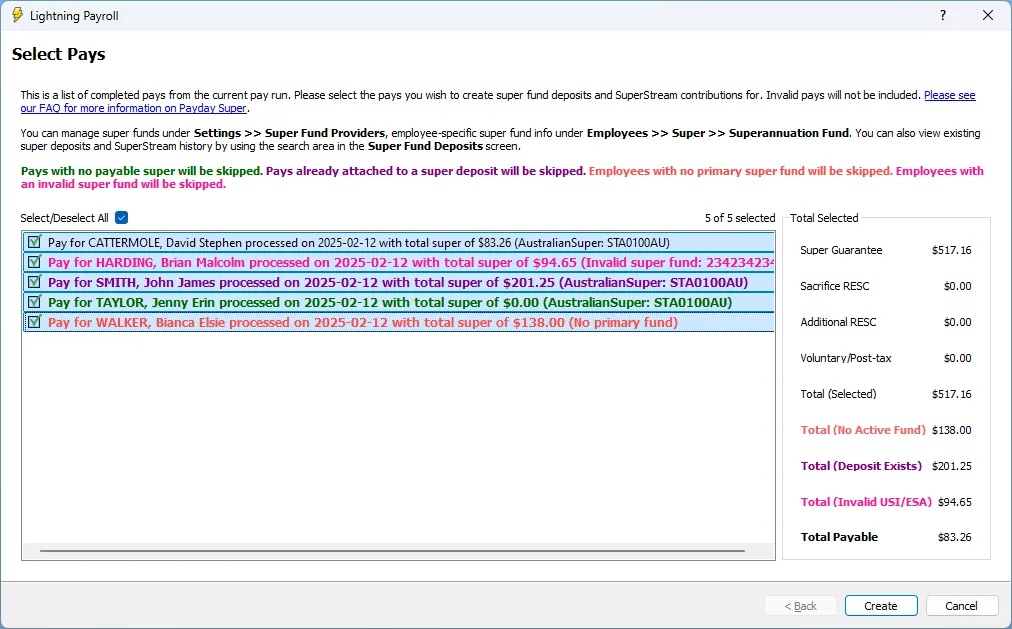

- Go back to the pay run list and click Payday Super (top-right of the screen).

- Select the RESC pays you just created and click Create.

- Follow the prompts to lodge the SuperStream file and make payment.

- Go back to the pay run list and click Payday Super (top-right of the screen).

- If you prefer the older workflow you can still use Super Fund Deposits, but Payday Super is faster for a single pay run. The deposit screen remains best for quarterly or other bulk payments.

Need more detail? See our dedicated Payday Super FAQ.

Method 2 – Pay June SG + RESC Together

If you wish to pay both SG and RESC for June before EOFY, use this method instead.

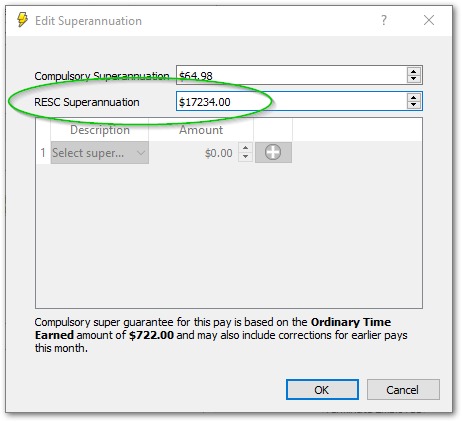

- Edit the employee’s last pay of the year under Pays >> Edit Pay/s.

- Click Edit beside Super.

- Add the extra RESC amount to the RESC field, leaving the SG amount as calculated.

- The additional super is immediately available for payment in Super Fund Deposits (or via Payday Super, if you prefer) and will be reported in your next Single Touch Payroll (STP) lodgement.