Answer

Getting Started with Payroll in Australia

Setting up a payroll for a new business in Australia involves understanding legal requirements, collecting necessary employee information, and ensuring compliance with tax and superannuation obligations. This guide outlines the key steps and provides links to essential resources.

Add a New Employee

When hiring a new employee, you’ll need to gather the following information and complete several forms to comply with Australian employment regulations:

Key Steps

-

Collect Employee Information:

Use our New Employee Basic Information Sheet (PDF) or

Word Document to record the employee’s details, including:

- Full name, address, and contact information

- Tax File Number (TFN)

- Superannuation fund details

- Bank account details for salary payments

- Complete Required Forms: Download and provide the following forms to the employee for completion:

-

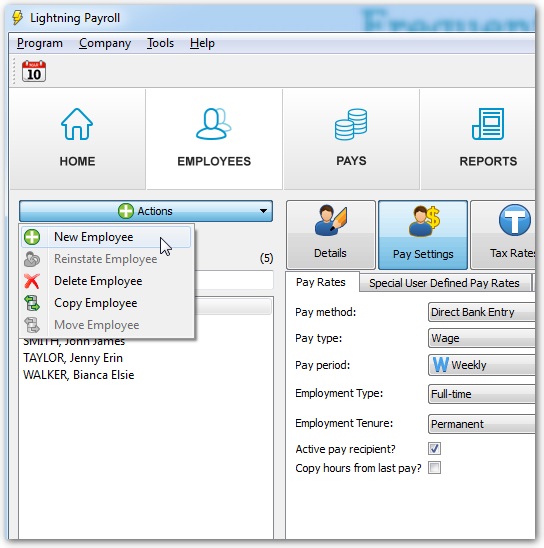

Enter the Employee into Lightning Payroll:

Once you’ve gathered the necessary details and forms, you can add the new employee to your payroll system:

Go to Employees >> Actions >> New Employee in Lightning Payroll.

Add a New Company/Business Entity

If your business operates multiple entities, Lightning Payroll allows you to manage them within the same system. There is no limit to the number of companies you can use in the software.

To add a new company entity:

- Go to Entities >> Add New Company.

- Complete the required fields, including the company’s legal name, ABN (Australian Business Number), and contact details.

- Set up the company’s default payroll settings, such as pay frequencies, tax rates, and superannuation options.

Additional Tips for New Businesses

- Register with the ATO: Ensure your business is registered with the Australian Taxation Office (ATO) for PAYG (Pay-As-You-Go) withholding and superannuation guarantee obligations.

- Understand Awards and Agreements: Familiarise yourself with applicable awards or enterprise agreements that cover your employees. Visit the Fair Work Ombudsman website for more information.

- Keep Accurate Records: Maintain detailed records of employee hours, wages, and entitlements for at least seven years as required by law.

For further guidance, visit our Support Page or contact our customer service team for assistance.