Answer

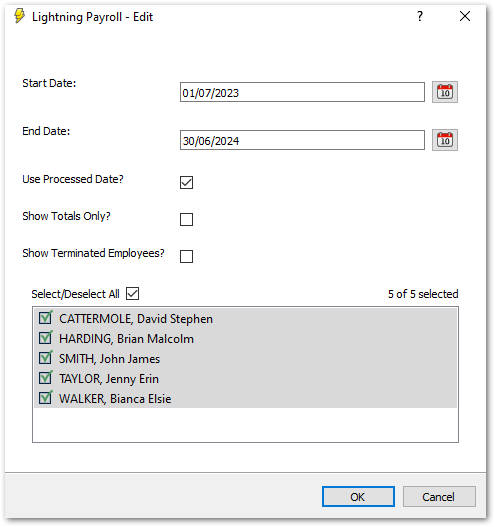

To accurately fill in your Business Activity Statement (BAS), it's important to use the appropriate reports with the correct settings to accurately reflect the period you are reporting. Lightning Payroll offers various reports, but for this purpose, we recommend using the Group Tax report. To generate this report:

- Navigate to Reports > Group Tax.

- Enter the relevant start and end dates.

- Tick 'Use Processed Date?'

- Select the employees.

- Click 'OK'.

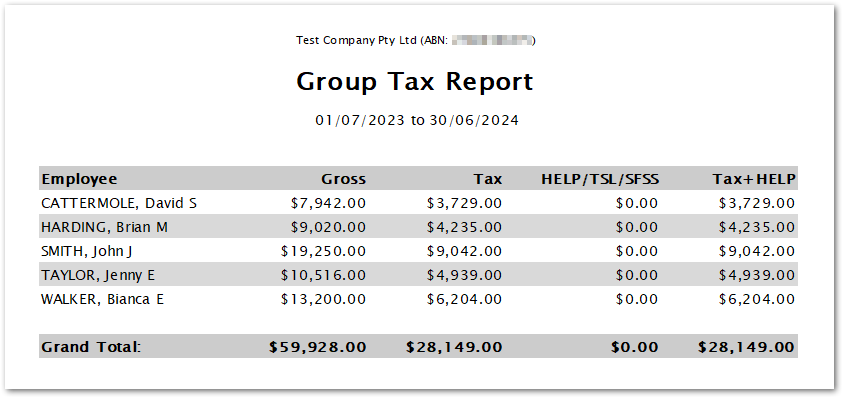

The totals in this report will give you the amounts for your W1 (Gross) and W2 (Tax) figures, including the HELP/TSL/SFSS components. By ticking "Show Totals Only?", each line will be condensed into their respective totals, making the report more concise.

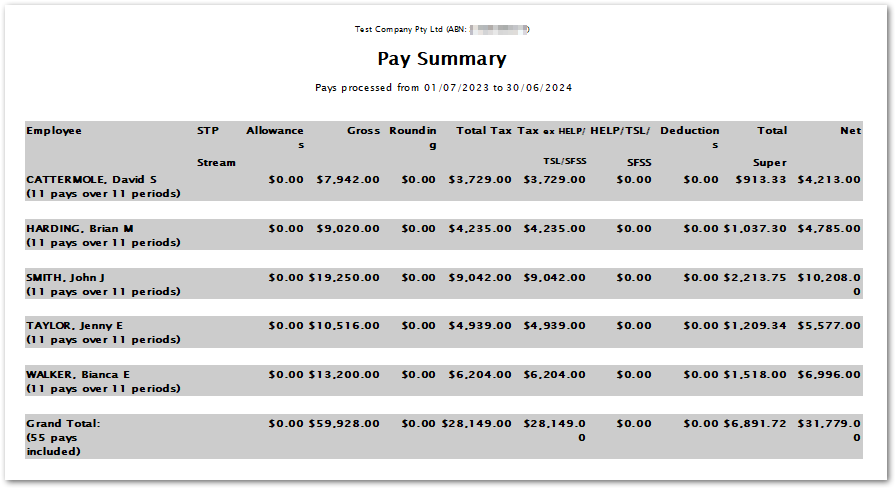

If you prefer a more detailed breakdown of other pay components, you can generate a Pay Summary report by:

- Navigating to Reports > Pay Summary.

- Using the dates as the Group Tax report, ensuring 'Use Processed Date?' is ticked.

Comparing the Pay Summary and Group Tax reports is an effective way to identify any discrepancies.

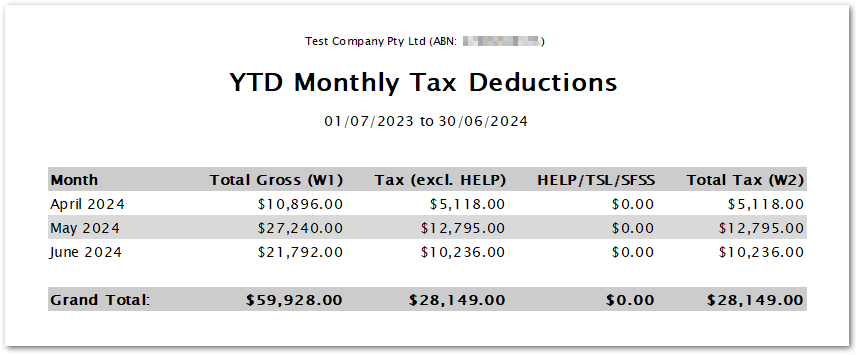

If you need to see which W1 and W2 values correspond to each month, use the Monthly Tax Deductions report:

- Navigate to Reports > Monthly Tax Deductions.

- Ensure the 'Use Processed Date?' checkbox is ticked.

This report provides a useful monthly breakdown of your W1 and W2 values.