Answer

This guide provides step-by-step instructions for Lightning Payroll users in Australia to correctly set up employees or contractors under a Voluntary Agreement for PAYG withholding.

Understanding Voluntary Agreements

A Voluntary Agreement is a contract between a payer (business) and a payee (contractor or employee) to withhold tax from payments. It's suitable for contractors with an Australian Business Number (ABN), helping them meet their tax obligations.

Should You Set Up a Voluntary Agreement?

Not all workers require a Voluntary Agreement. This setting is typically used for contractors rather than regular employees. Incorrectly declaring an employee under a Voluntary Agreement can lead to errors when submitting Single Touch Payroll (STP) data.

Configuring a Voluntary Agreement

- Go to the Employees tab.

- Select the employee's name you wish to configure.

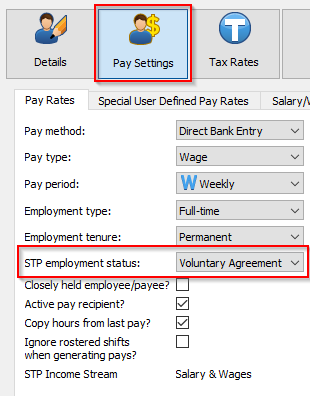

- Navigate to Pay Settings > Pay Rates.

- In the STP Employment Status dropdown, select Voluntary Agreement if applicable.

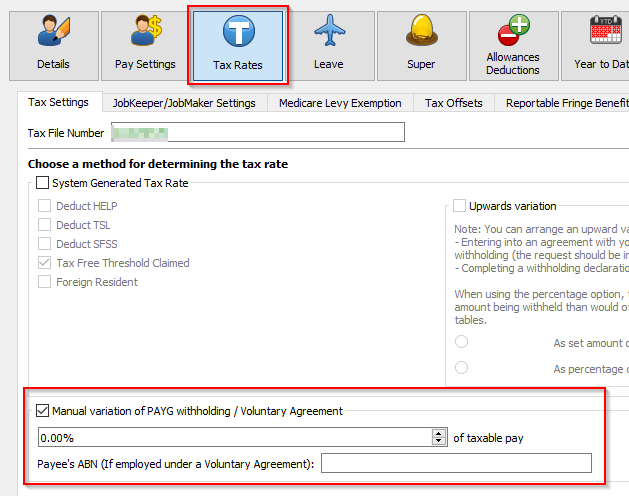

- Click the Tax Rates button, located to the right of Pay Settings.

- Under Tax Rates > Tax Settings, tick "Manual Variation of PAYG withholding / Voluntary Agreement".

- Enter the payee's ABN.

Important Considerations

Ensure that the worker is actually a contractor eligible for a Voluntary Agreement. Regular employees typically do not qualify for this arrangement. Incorrect use of this setting can result in submission errors.

Both the business and the contractor should keep a copy of the agreement for their records, but there's no need to send a copy to the ATO. It's important to maintain accurate records to ensure compliance.

For more detailed guidance on Voluntary Agreements and PAYG withholding requirements, please refer to the Australian Taxation Office (ATO) website.