Answer

This FAQ explains how STP Phase 2 affects W1 and W2 pre-filling in your BAS, and when (and why) you might use an Adjust event in Lightning Payroll. It’s designed to help employers understand how STP reporting relates to their PAYG obligations, BAS lodgements, and employee year-to-date records. By the end, you’ll know which reports to rely on, what information is truly critical for compliance, and why most adjust events are optional and often just for peace of mind.

1 · Accurate Year-to-Date (YTD) Reporting Is Paramount

Key point: Every New and Update Single Touch Payroll (STP) submission must carry correct year-to-date (YTD) figures for each employee. These YTD totals feed the employee Income Statement and are the part of STP that the ATO relies on most.

2 · W1 & W2 Explained – How STP Phase 2 Prefills Your BAS

W1 is the total gross payments you have made to workers for the BAS period. W2 is the total tax withheld from those payments. Under STP Phase 2 the ATO uses the gross and tax components of your New and Adjust events to pre-populate W1 and W2 on your activity statement. Prefill is only a convenience check; you can and should overwrite it with the figures from your own payroll reports if they differ.

To confirm your real BAS totals, run either a Group Tax or Pay Summary report in Lightning Payroll for the period. Enter those W1 and W2 values when you lodge. Lodged BAS figures are what matter for PAYG obligations, not the prefill.

3 · STP Event Types & Their Roles

- New – sends full YTD data for all employees in the pay run plus employer-level W1 and W2 for that pay date range.

- Update – sends updated YTD data only; it does not affect employer W1 or W2.

- Adjust – sends only the difference that you need to add or subtract from previously lodged W1 and W2 totals for the period. Employee YTD data stays unchanged.

Because BAS relies on totals you actually lodge, Adjust events are largely for tidy record-keeping. Your BAS will be correct so long as you key in the right W1 and W2 figures, even if you never lodge an Adjust.

For a more detailed explanation of these event types, see our full FAQ on New, Adjust and Update events.

4 · When to Use an Adjust Event

Avoid an Adjust event unless you are certain the ATO’s prefill is out by a known amount and you want that cleared for peace of mind. An Adjust is optional; it is not required to lodge a correct BAS or PAYG.

5 · Reconciling Lightning Payroll Totals With the ATO

1. Generate a Group Tax report using the processed date filter.

2. Note the W1 and W2 totals.

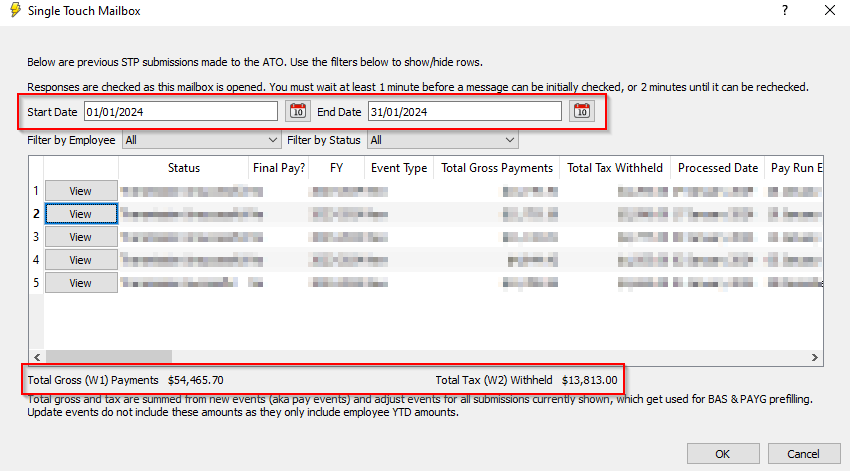

3. Open Pays > Single Touch > Single Touch Mailbox and filter to the same dates.

4. Compare the totals shown beneath the mailbox table (these include New and prior Adjust events only).

6 · Calculating and Lodging an Adjust Event

If the totals differ:

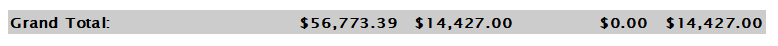

- Subtract the mailbox W1 and W2 from your report W1 and W2.

Example: W1 difference = $56,773.39 – $54,465.70 = $2,307.69 (positive).

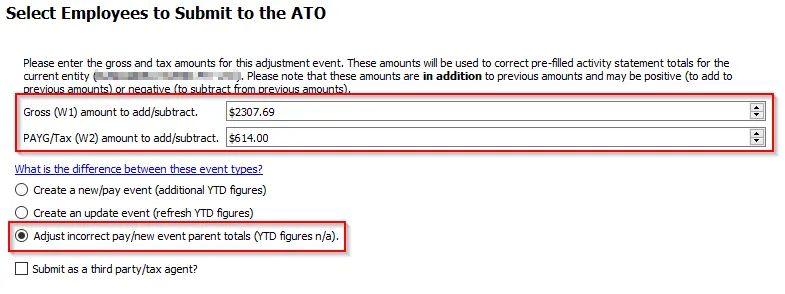

W2 difference = $14,427.00 – $13,813.00 = $614.00 (positive). - Go to Pays > Single Touch > Submit Payroll to ATO and choose Adjust incorrect pay/new event parent totals.

- Enter positive values to increase W1 or W2, or negative values (e.g.

-500.00) to reduce them.

7 · After You Lodge

Allow up to 72 hours for the adjustment to appear in Online Services for Business and to refresh any BAS prefill, although it usually updates straight away.

Remember: The figures you type on your BAS are final for PAYG. Accurate employee YTD data is already handled by your regular New or Update events, so do not stress if an adjust event feels unnecessary. Lodge the right W1 and W2 and you are compliant.