Answer

All references below are taken from the ATO Single Touch Payroll Business Implementation Guide v3 (published August 2023). This is the official document used to implement business logic regarding Single Touch Payroll.

Within the ATO's Online Services For Business page (under Employees >> STP Reporting) you can see a record of your STP event history, which will coincide with the more detailed records shown in Lightning Payroll under Pays >> Single Touch >> Single Touch Mailbox. In the Online Services For Business page you will see totals for STP New/Pay Events & Adjust Events, but not for Update Events.

The W1 (gross salary and/or wages) and W2 (PAYG tax withholding) STP pay run totals can cause a lot of confusion, as do the three event types (New/Pay Event, Adjust Event and Update Event). In Lightning Payroll we most often refer to Pay Events as New Events, since they are for submitting new pay information (ie. submitting for the first time), and not for updating or adjusting earlier lodgements (ie. subsequent submissions).

The main difference shown in the Online Services For Business page is that Pay/New Events contain W1 and W2 totals, where Update Events do not. This is not a Lightning Payroll rule, this is an ATO STP rule.

Said another way, the reason your pay run totals are not showing up in the Online Services For Business page is because you are sending Update Events, when you should be sending New/Pay Events. This is not a major problem, however as the main point of STP is to report employee YTD amounts, and these will be reported in full either way; the difference is only in what you can view. The pay run totals shown in the Online Services For Business page are just used for prefilling BAS amounts, as mentioned below.

If you are unable to select employees to send in a New Event it is because you are sending STP for pays with processed dates too far in the past. 14 days is as far back as fixups are allowed, and past dates are discouraged by the ATO.

You must send a New Event on or before pay day for pay run W1 and W2 totals to be included in the message and on the Online Services For Business page.

If your processed dates are incorrect you will need to fix these in Lightning Payroll under Pays >> Set Processed/Paid Date For Pay Run at the bottom of the screen. If you use direct entry to pay your staff, your pay processed dates will be automatically adjusted to reflect the processing date of your direct entry (ABA) banking file.

Pay Event (New Event)

A Pay Event (called a New Event in LP) is the primary STP message type. "Whenever an employer makes a payment to an employee that is subject to withholding they are required to lodge a Pay Event message with the ATO on or before the date the payment is made." B.I.G. page 17. Lightning Payroll will always automatically suggest a New Event whenever you're sending pay/s for the first time (based on processed date, not pay run dates). New Events only include totals for employees with completed pays on the particular pay run you're submitting from.

Adjust Event

An Adjust Event reports adjustment amounts for the 'Payer Total Amounts' of gross salary/wages (BAS label W1) and PAYG withholding (BAS label W2) previously reported via a submit action for the specified payment date. The adjust action cannot be used to report or correct individual payee details; it is for adjusting the total gross (W1) and total tax (W2) of a pay run (these totalled figures can be found along the bottom of pay runs in the Pays screen). The payee details are corrected through an Update Event, or with the next Pay/New Event sent for that employee.

Update Event

The Update Event allows the employer to report changes to employee YTD amounts previously reported, or to report fix-ups within 14 days of payment. The update event cannot be used to supply (B.I.G. page 19):

- Employer ‘Total gross payments’ and ‘Total PAYGW Amounts’.

- The onboarding section (which contains the employee withholding details and declaration).

"As there is no associated payment to the employee when changes are reported via the update event, the employer pay period totals for gross payments and PAYG withholding cannot be included in an update event."

What Are The Pay Event W1 and W2 Totals Shown in the Online Services For Business Used For?

"For an employer who pays their PAYG withholding with their BAS, the ATO will aggregate W1 and W2 across all BMS IDs for pre-filling of the employers BAS." B.I.G. Section 3.1.2 (part 3).

How Do I Correct These Totals?

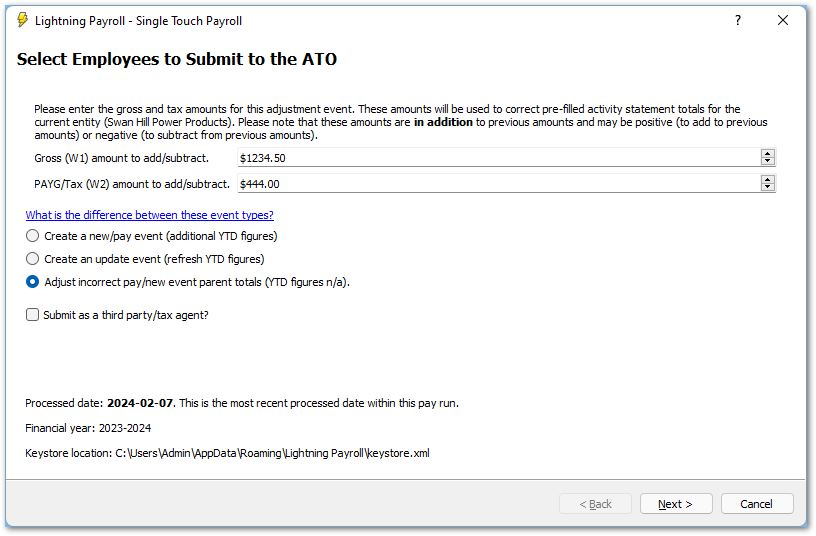

To correct the W1 and W2 totals shown in the Online Services page you may send an Adjust Event under Pays >> Single Touch >> Submit Payroll To ATO >> Adjust incorrect pay/new event parent totals. The amounts entered can be positive or negative value, and will add to, or subtract from, existing amounts submitted - they do not overwrite. Adjust Events will correct pre-filled BAS figures, whereas Update Events will not.

Where Can I Find More Information?

To read more about the rules of STP, please visit the ATO web site.