Answer

Note: This method will only work for users who have submitted STP for at least one event throughout the financial year being reported.

Before You Begin

For online/mobile users, you will need to register your SSID. For desktop users, you will require a valid ATO Machine Credential.

Lodgement

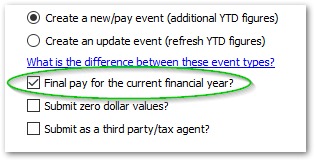

Submit STP as usual, by clicking yes on the prompt when completing your pay run, or by clicking Single Touch >> Submit Payroll to the ATO from the last pay run with a processed date in June in the Pays screen.

The only difference with submitting the last pay of the financial year is to tick the box that says Final pay for the current financial year?.

On the next page, you can select your credential (for desktop users), print, preview and submit as normal. That's all there is to it.

If submitting a New event finalisation only, you may find that employees not included in the final pay run are missing. This is normal. For the final pay run of a financial year only, we recommend you send STP a second time, again making sure to tick the Final pay for the financial year box. This second run of STP will naturally be an Update event, which allows you to send STP for all employees paid within the financial year, meaning no one misses out on being finalised. It's okay to submit employees in both the New and Update finalisation events; their figures will not be 'doubled up' or anything similar.

The next pay run will begin your new financial year and all YTD figures will begin again upon the completing of your first pay run with a processed date in July.

ATO Responses:

To check for responses, simply go into Single Touch >> Single Touch Mailbox and Lightning will see if anything has been returned from the ATO. Lightning Payroll also automatically checks responses for you upon shutdown of the desktop program, and overnight for online/mobile users. Responses take anywhere from two minutes to three days to come back. The program will not recheck until at least two minutes since the last check.