Answer

Lightning Payroll can only calculate PAYG withholding on the payments you process in our software. It does not know what the employee earns, or what tax is withheld, by any other employer. This is expected behaviour and aligns with ATO guidance.

When an employee has more than one job:

- The employee should usually claim the tax-free threshold from one payer only (typically their main job). They choose this when completing the Tax File Number (TFN) declaration for each employer.

- For the second job, the employee typically selects “No” to claiming the tax-free threshold. This makes withholding higher on that job alone so that overall tax is closer to correct across both jobs.

- There is no special “second job” tax scale. Employers simply apply the standard ATO withholding formulas/tax tables based on the threshold, Medicare levy, and any study/training loan settings the employee has declared.

It’s important to remember that PAYG withholding is only an estimate of annual tax. This is one of the main reasons individuals complete an end-of-year tax return — so that the ATO can reconcile total income and withholding across all jobs and ensure the correct amount of tax is paid.

Adjusting Withholding If Needed

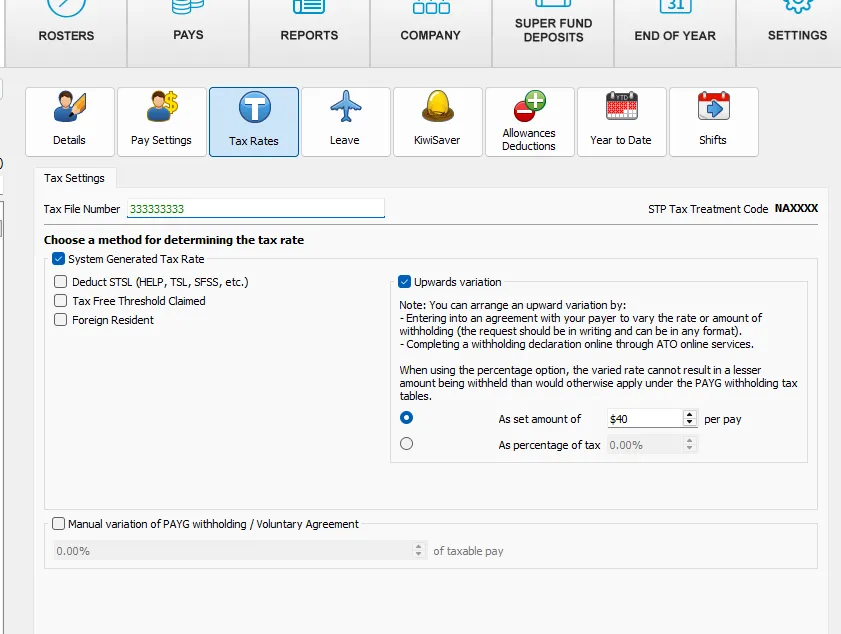

If the employee is worried about not having enough tax withheld during the year, they can ask you to withhold extra. In Lightning Payroll this can be done by going to:

- Employees >> Tax Rates >> Tax Settings >> Upwards Variation

Here you can enter a set amount (for example, $xx.xx per pay) to be withheld in addition to the standard PAYG calculation.

Key Takeaways

- Lightning Payroll can’t factor in pay from other employers. That’s normal and per ATO rules.

- Have the employee claim the tax-free threshold with one payer only; select no threshold with others.

- There are no extra tax scales to configure for a second job.

- Pays will usually balance out when the individual tax return is lodged at the end of the year.

- If extra tax should be withheld, set an Upwards Variation in Lightning Payroll.

Helpful ATO Links:

Multiple Jobs or Change of Job – When to Claim the Tax-Free Threshold

Paying Tax on Multiple Sources of Income

Withholding Declaration (include extra withholding or change threshold)

PAYG Withholding Tax Tables & Calculator