Answer

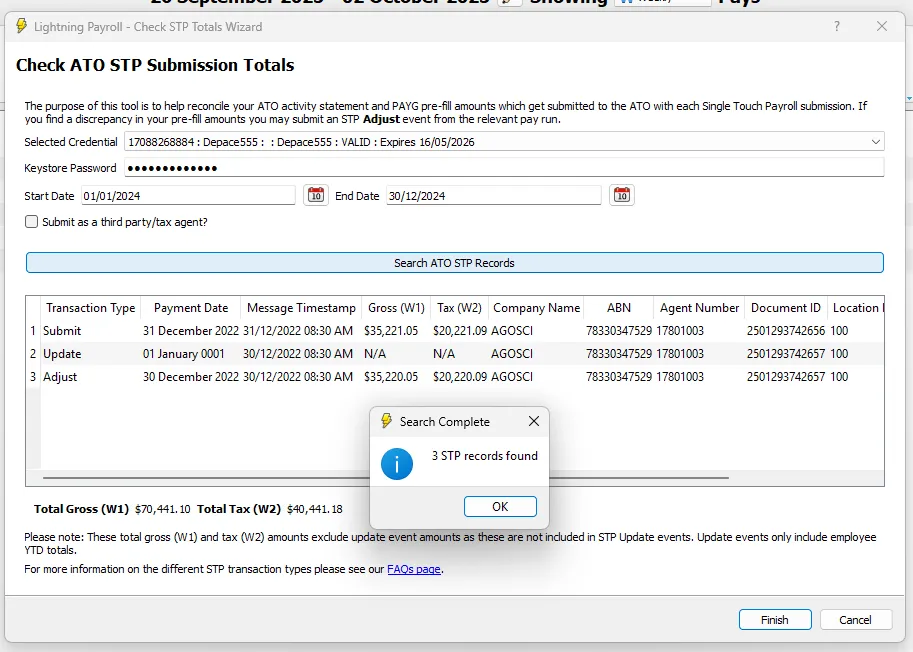

The Single Touch Recon tool in Lightning Payroll’s desktop version allows you to view your Single Touch Payroll (STP) submission records as received by the ATO. It’s designed to help reconcile your STP totals against your ATO activity statement and PAYG withholding pre-fill amounts.

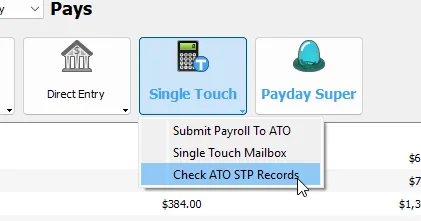

You can find this feature by navigating to Pays >> Single Touch >> Check ATO STP Records in the desktop software:

This tool is not available in the web or mobile versions of Lightning Payroll. If you are using those platforms, or prefer to access this information directly, you can always log in to the ATO’s Online Services for Business page.

How to Use the Tool

To check your ATO STP records using this tool:

- Select the correct machine credential for the current company’s ABN.

- Enter your M2M (Machine-to-Machine) credential password.

- Set a date range to search. The selected range must be less than 12 months.

- Click Search to retrieve your ATO STP submissions within the chosen period.

If records are found, they will be listed with full details, allowing you to compare them to your ATO activity statement or PAYG withholding totals.

Resolving Discrepancies

If you notice discrepancies in your PAYG pre-fill amounts, you may need to submit an STP Adjust event from the affected pay run. These events allow you to correct amounts previously sent to the ATO.

For step-by-step guidance on using Adjust events, see this FAQ.

Important Notes About Errors

When using the recon tool, ensure the ABN and PAYG Withholding Branch ID under Company >> Details match the original details used during STP submission. If these have changed since your original submissions, the tool may not be able to locate your past records.

The branch ID is entered here in Lightning Payroll:

- Company >> Details >> PAYG Withholding Branch/Location ID

If necessary, you can temporarily change these fields to match a previous ABN or branch ID to look up older submissions. Just be sure to change them back to your current values afterwards.

Alternative Access to STP Records

This tool is provided as a convenience. You do not need to use it to access your STP history. All STP records can always be reviewed through the ATO’s Online Services for Business portal:

We recommend checking this site if you cannot locate submissions within Lightning Payroll or if you are using our web or mobile versions.